COMMODITYPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR COMMODITYPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.commoditypivots.com

CLICK HERE

THE COMMODITYPIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER IS A PUBLICATION OF

FOR CURRENT PREMIUM DESK ARTICLES , POSTS, ANALYSIS, COMMENTARY, ALERTS AND STRATEGY RELEASES FOR ALL MARKET ALPHA NEWSLETTERS GROUP PUBLICATIONS FOUND CURRENTLY FREE ONLINE AT THE GROUP'S CONSOLIDATED NEWSLETTER FREE ONLINE VERSION SITE

CLICK HERE COMMON

Click Here To View The Free Online Version Of The COMMODITYPIVOTS Forecaster, Including Timely EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots, Providing Key Market Intelligence And Technical Analysis For Active Advanced COMMODITIES MARKET Focused Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Related Indexes, ETFs, Options, Futures, And Other Securities!

DIRECT LINKS - RSS FEED POST UPDATES (INCLUDING COMMODITYPIVOTS.COM FREE ONLINE SECTOR COMPONENTS) BELOW: CLICK BELOW FOR DIRECT ACCESS TO THE MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASED EASYGUIDE TRADERS EDGE FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS NOW FREE ONLINE AT THE MARKET PIVOTS FORECASTER CONSOLIDATED ONLINE VERSION! CLICK ON LATEST POST TITLES IN THE RSS FEED PRESENTED BELOW:

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Is Presented As A Focus Sector Inclusion Of

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Also Includes The Free Online Content And Information For The Free Online Versions Of:

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

CLICK ON THE TITLES BELOW FOR THE LATEST POSTS OF

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Includes The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Presented As A Focus Sector Inclusion With Timely COMMODITIES MARKET Sector Related EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots And Providing Key Market Intelligence And Technical Analysis For Active Advanced Focused COMMODITIES MARKET Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Indexes, ETFs, Options, Futures, And Other Securities!

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

RSS LINK INTRO

THE MARKET ALPHA NEWSLETTERS GROUP'S NOW FREE ONLINE CONSOLIDATED VERSION'S (INCLUDING COMMODITYPIVOTS.COM) MOST RECENTLY GLOBALLY PUBLISHED POSTS TITLE LINKS APPEAR BELOW (DIRECT LINKS - RSS FEEDS UPDATED)

(CLICK ON TITLE LINKS PROVIDED BELOW TO ACCESS THIS MOST RECENT MARKET ALPHA NEWSLETTERS GROUP CONSOLIDATED VERSION POSTS, NOW FREE ONLINE, INCLUDING SELECT MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHARTS AND TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS - HIGHLIGHTED AND ILLUSTRATED UPDATES!)

EchoVectorVEST RSS FEED LAST 5 ENTRIES

ENLARGE

_________________________________________________________________________________

HOW TO ENLARGE ECHOVECTOR ANALYSIS CHART IMAGES BY ECHOVECTORVEST ON YOUR COMPUTER MONITOR'S DISPLAY_________________________________________________________________________________

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

Friday 23 August 2013

See echovectorvest.blogspot.com for significant commoditypivots.com updates this week in the precious metals market.

Thursday 22 August 2013

Recent Article Links

Will Silver's Upside Price Action Continue?

on Thu, Aug 22 • SLV •

As In Previous Quarters, This Is A Very Important Week In The Gold Market

on Wed, Aug 14 • GLD, NUGT •

Is Silver Setting Up For Significant Upside Price Action This Month?

on Fri, Aug 9 • GLD, SLV •

Today's EchoVector Pivot Point Chart And Analysis: Silver

on Wed, Jul 31 • SLV •

SELECT ADDITIONAL PAST ARTICLES

Gold Charts: Warning In February Still Valid Today

on Mon, May 20 • GLD, GTU, IAU •

Gold Chart: Price May Be Right, But Is Timing?

on Wed, Feb 27 • GLD •

Gold Chart: Cyclically An Important Week In Gold

on Mon, Feb 11 • GLD •

on Thu, Aug 22 • SLV •

As In Previous Quarters, This Is A Very Important Week In The Gold Market

on Wed, Aug 14 • GLD, NUGT •

Is Silver Setting Up For Significant Upside Price Action This Month?

on Fri, Aug 9 • GLD, SLV •

Today's EchoVector Pivot Point Chart And Analysis: Silver

on Wed, Jul 31 • SLV •

SELECT ADDITIONAL PAST ARTICLES

Gold Charts: Warning In February Still Valid Today

on Mon, May 20 • GLD, GTU, IAU •

Gold Chart: Price May Be Right, But Is Timing?

on Wed, Feb 27 • GLD •

Gold Chart: Cyclically An Important Week In Gold

on Mon, Feb 11 • GLD •

Sunday 18 August 2013

GLD ETF 2-Year Daily OHLC Chart Update for Article "As In Previous Quarters, This Is A Very Important Week In The Gold Market" Monday 19 August 2013

Wednesday 14 August 2013

GOLDPIVOTS.COM ARTICLE

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in GLD, DGP, UGLD, NUGT, GTU, IAU over the next 72 hours. (More...)

This week three quarter ago I alerted the gold market to

what then was a cyclically important week in gold. The two weeks of

trading that followed proved to be of great interest to participants

worldwide. The price of gold fell significantly, trading down from

around $160 on the GLD ETF to a low just below $151, a fall of over 5.5%.Then on February 27th, When gold was bouncing off a seeming near-term bottom and many analyst where again filled with risk-on enthusiasm for the precious metal, I suggested that regardless of price level, a more prudent time to enter gold was closer to the end of June. See "Gold Chart: Price May Be Right, But Is Timing?"

On May 20th I also put out a third article on gold titled, "Gold Charts: Warning In February Still Valid Today" in which I warned that this year's seasonal down-pressure was still likely not over. The wisdom of February's article had become fully apparent by then, with gold prices down another 20%, and the GLD near $131.

In my May article I reiterated the importance of patiently waiting for the end of June to find a positive risk-reward re-entry time-point for gold. Another final leg down was forecast. As it ended up, it would have been hard for me to have been more correct, with gold falling further in June to a closing low on the GLD the week of June 27TH below $116.

This first half of 2013 did in fact prove to be an historic sell-off in gold prices. My model then indicated a strong buy signal on June 27TH, the week it was forecasted due in, which I had also published at my website, GOLDPIVOTS.com.

FUNDAMENTALS SUPPORTING GOLD THIS WEEK

This week the GLD has risen from its June's lows to a high just above $129.50, and as in previous quarters, now may be time to look at gold's favorable fundamentals.

1. The timeliness of annual seasonality coming in for gold prices. August is often a key month for gold.

2. Unemployment remains a chronic and unresolved problem, with an uncertain outlook, which is often a positive for gold prices.

3. Federal Reserve tapering issues still remain on-again off-again blurry, and a continuing dovish Fed monetary posture regardless remains likely, also positive for gold.

4. Chinese gold buying remains strong (even though some headlines may suggest otherwise) with China likely becoming the largest gold purchaser in the world on an annual basis this year.

5. Gold Mining stocks have also begun to rebound, which may be an indicator of better production cost to expected metals price ratios (which also makes miners particularly interesting as an alternate gold investment). The NUGT ETF this month is outperforming.

6. And gold is still considered a viable hedge by some analyst against a correction in stock prices (which some analysts are anticipating sometime this fall, if not sooner).

A LOOK AT THE CHARTS

The following chart updates my chart from February of the GLD ETF illustrating how waiting until about the beginning of July has been a very good annual risk-on risk-management strategy for gold since July 2009.

(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

(Click to enlarge)

Now, this week is particularly important for the gold metals going forward into August's primary option expiration, and also going forward into the three week's thereafter, from an EchoVector Analysis Perspective. Last year, the three weeks that followed options expiration proved particularly strong on relative price strength basis within an annual echovector perspective.

Zooming into this perspective on the chart below, we see (highlighted in red) the currently active annual echovector running to this week's current high on Monday from its coordinate echo-back-week high on the corresponding Monday one year ago. We also see this year's coordinate green extension vector (symmetrical to the prior four years) leaves prices additional room to rise from current levels -- a rise to the $135 price level on the GLD, before reaching parity. If prices hold up this week going into expiration, this may indicate gold might be staging for a nice price lift in the following weeks that could last well into mid-September.

(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

(Click to enlarge)

ADDITIONAL ANALYSIS

If gold does not hold up the next few day's going into expiration, or shows little or no following lift next week, we could see the annual echovector start to pivot downward again with gold potentially revisiting its summer lows in the near term. Keeping a close eye on this time-period, as well as the impacts of the quarterly echovector, the bi-quarterly echovector, the tri-quarterly echovector this week and next could help signal early gold's price bias and movement on into fall. In the chart below each of these key echovectors is highlighted. Notice the relatively strong downward momentums each of these three shorter term echovectors presents. The quarterly echovector is highlighted in solid white, the bi-quarterly echovector is highlighted in solid yellow and the tri-quarterly echovector is highlighted in solid blue-purple. Each of their currently corresponding near-term August option's expiration low coordinate forecast echovectors are highlighted in the respective spaced-color equivalent.

(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

(Click to enlarge)

If gold's price stays above the red-spaced annual coordinate forecast echovector going into options expiration and for the several days thereafter, each of these shorter-term echovectors will begin to pivot upward. This could add additional bullishness to gold prices going into the following weeks, and strengthen potential price level gains from any annual seasonality that may be in effect. Traders and investors will want to focus on these dynamic echovector perspectives in the few days ahead. This potential added bullish scenario would be a very positive technical outcome for gold prices in the near-term.

It currently appears that the risk-reward ratio to any risk-on position may begin to increase dramatically the week of primary options expiration in September on an annual echovector perspective basis. However the longer-term 4-year presidential cycle echovector, coupled with this potentially positive short-term scenario, could propel prices higher beyond September. This is illustrated in the following chart.

(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

(Click to enlarge)

Will the price of gold start to shine again soon, and gold break out above the $130 level, setting this potential bullish scenario in motion? Fundamental arguments have been presented by many analyst for this possibility the last several weeks, and crucial technical support for this possibility may also be forming this week as presented in this extended analysis. How to measure and interpret the next several days of trading price action has also been discussed. And the possible ramifications to gold's outlook this fall, and into the remainder of the year have been discussed. This is an important week in gold. So now may be a very good time to re-assess gold's near-term attractiveness and its eventual longer term potential standing within your portfolio.

Thanks for reading.

Which Seeking Alpha App is best for you?

Seeking Alpha Portfolio

Tech Investor

ETF investor

Energy Investor

Email me a link to open from my phone:

Continue

-

Share this article

Short URL:

About this article

Emailed to:

299,549 people who get Macro View daily.

Problem with this article? Please tell us. Disagree with this article? Submit your own.

More articles by Kevin Wilbur »

- Is Silver Setting Up For Significant Upside Price Action This Month? Fri, Aug 9

- Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective Wed, Aug 7

- Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond Mon, Aug 5

- Today's EchoVector Pivot Point Chart And Analysis: Silver Wed, Jul 31

- Gold Charts: Warning In February Still Valid Today Mon, May 20

Friday 9 August 2013

Today's EchoVector Pivot Point Chart And Analysis Update: Silver

Today's EchoVector Pivot Point Chart And Analysis Update: Silver

includes:SLV

This year's dramatic gold and silver price declines are big news. However, since July price lows, some gold and silver analyst are suggesting a price bounce may now be underway, particularly in silver, which at a fundamental level may possess certain additional positives.

Silver is used more broadly than gold for industrial purposes. Silver demand overseas, particularly in Southwest Asia, has recently been reported to be reaching record levels. Silver coin demand in North America is stronger than ever on certain measures. HSBC, a significant bullion bank, sees silver prices remaining in a new and lower trading range this year, but still sees a potential upside target for the precious metal over that is 3 points higher than its current price occurring sometime before year's end. Recent options activity in silver also appears more bullish. Some indications of possible supply growth reductions in silver in the near-term currently exist. And forces inducing the central bank's generally loose monetary policy in the United States, high unemployment level in particular, appear unresolved.

In late August I presented "Today's EchoVector Pivot Point Chart And Analysis: Silver" which also looked at silver's annual price chart from an EchoVector Price Analysis Perspective highlighting occurrences of silver's annual price pattern symmetries' and the possible near-term trading implications of them. Significant symmetries were presented. I focused on the SLV ETF chart as my proxy for silver metals market price action. Today I would like to also provide a very interesting update to that SLV price chart I presented as well.

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

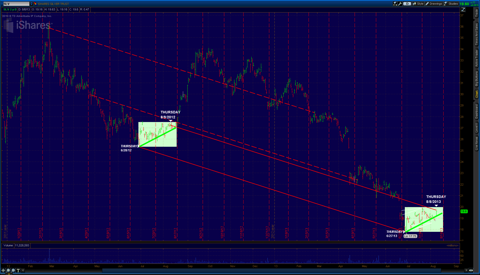

Looking at today's chart update, we can see once again very clearly the significant symmetry that emerged in the key active annual echovector (highlighted in solid red) running to this year's current price low on Thursday June 27 from its corresponding echo-back-date low one year earlier on Thursday June 28, 2012.

Thursday this week we had a gap open in the SLV, with good price extension through lunch time, and a close near the high of its daily trading range.

And very interestingly, we can now also see that the annual echovector to Thursday August 8 from its corresponding annual echo-back-date of Thursday August 9 2012 is a parallel, and that this same echovector momentum and powerful price symmetry coordination is still very much in effect.

This year's green highlighted time-price box which corresponds to last year's coordinate green time-price box (which continued last year until silver's price 'broke out' last August 20), and these boxes symmetry, also remain very much intact, and continue in remarkable coordination.

We can very interestingly see that this year's ascending green echo-price support vector located within this year's green box also served as the gap opening price support level in Thursday's relatively strong price action.

As I mentioned in July's article, analyst may find last year's price action and this year's effective symmetries very suggestive from an echovector pivot point perspective, and for forming their silver price outlook. And the next several week's could prove particularly interesting in this formulation. If a reasonable price echo and its extension in this period of August or September doesn't occur, additional short selling pressure to new price lows could form on a technical basis.

Silver's strong price up-draft last year occurred once prices broke out of the trade box in August after last August's significant 3RD Saturday options expiration date. This strong updraft and positive price extension lasted well into mid-September. These past price movements and patterns may become particularly significant to trader's as we move into this year's corresponding week's, given this year's current active price symmetries and coordinated price momentum currently active at these key time-points and their echovectors.

Thanks for reading. And good luck in your silver investing and trading!

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long SLV. I have a current swing trading position in SLV initially opened Friday August 31 2013. I may be looking to possibly add to my position as this week and month progress.

This article is tagged with: Gold & Precious Metals

This year's dramatic gold and silver price declines are big news. However, since July price lows, some gold and silver analyst are suggesting a price bounce may now be underway, particularly in silver, which at a fundamental level may possess certain additional positives.

Silver is used more broadly than gold for industrial purposes. Silver demand overseas, particularly in Southwest Asia, has recently been reported to be reaching record levels. Silver coin demand in North America is stronger than ever on certain measures. HSBC, a significant bullion bank, sees silver prices remaining in a new and lower trading range this year, but still sees a potential upside target for the precious metal over that is 3 points higher than its current price occurring sometime before year's end. Recent options activity in silver also appears more bullish. Some indications of possible supply growth reductions in silver in the near-term currently exist. And forces inducing the central bank's generally loose monetary policy in the United States, high unemployment level in particular, appear unresolved.

In late August I presented "Today's EchoVector Pivot Point Chart And Analysis: Silver" which also looked at silver's annual price chart from an EchoVector Price Analysis Perspective highlighting occurrences of silver's annual price pattern symmetries' and the possible near-term trading implications of them. Significant symmetries were presented. I focused on the SLV ETF chart as my proxy for silver metals market price action. Today I would like to also provide a very interesting update to that SLV price chart I presented as well.

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

Looking at today's chart update, we can see once again very clearly the significant symmetry that emerged in the key active annual echovector (highlighted in solid red) running to this year's current price low on Thursday June 27 from its corresponding echo-back-date low one year earlier on Thursday June 28, 2012.

Thursday this week we had a gap open in the SLV, with good price extension through lunch time, and a close near the high of its daily trading range.

And very interestingly, we can now also see that the annual echovector to Thursday August 8 from its corresponding annual echo-back-date of Thursday August 9 2012 is a parallel, and that this same echovector momentum and powerful price symmetry coordination is still very much in effect.

This year's green highlighted time-price box which corresponds to last year's coordinate green time-price box (which continued last year until silver's price 'broke out' last August 20), and these boxes symmetry, also remain very much intact, and continue in remarkable coordination.

We can very interestingly see that this year's ascending green echo-price support vector located within this year's green box also served as the gap opening price support level in Thursday's relatively strong price action.

As I mentioned in July's article, analyst may find last year's price action and this year's effective symmetries very suggestive from an echovector pivot point perspective, and for forming their silver price outlook. And the next several week's could prove particularly interesting in this formulation. If a reasonable price echo and its extension in this period of August or September doesn't occur, additional short selling pressure to new price lows could form on a technical basis.

Silver's strong price up-draft last year occurred once prices broke out of the trade box in August after last August's significant 3RD Saturday options expiration date. This strong updraft and positive price extension lasted well into mid-September. These past price movements and patterns may become particularly significant to trader's as we move into this year's corresponding week's, given this year's current active price symmetries and coordinated price momentum currently active at these key time-points and their echovectors.

Thanks for reading. And good luck in your silver investing and trading!

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long SLV. I have a current swing trading position in SLV initially opened Friday August 31 2013. I may be looking to possibly add to my position as this week and month progress.

Monday 5 August 2013

Treasury Long Bond: Today's EchoVector Pivot Point Charts And Analysis

Treasury long bond prices have seen difficult times recently. Since the beginning of May this year, and shortlyafter the Federal Reserve hinted it was developing a schedule for winding down its $85 billion dollar per month bond purchasing program, Fed 'tapering' speculation hit the bond market hard, and sent the price of bonds down rather quickly, and quite dramatically. An 8% drop occurred during just that first month of May, from about $124 to about $114 as measured by the TLT ETF.

And, although the Fed has since attempted to mitigate its language and posture to indicate that purchasing will remain steady, the bond market has continued to weaken further. Investors have elected to continue their strong preference for rising stocks.

June remained poor for bond prices, seeing The TLT drop another 6 points from $114 to $108, and setting up an additional early July drop to nearly $106, before the damage to prices seemed to halt.

Many article's followed, with some analysts seeing bonds stabilizing, and again 'becoming a buy', while other analysts warned of continuing price weakness into the end of the year, and potentially beyond.

On balance, treasury long bond prices did stabilize through much of the remainder of July, finding continued technical support in this new price range. However, last week's mid-week FedSpeak activity apparently provided little additional support to bond prices; and, in fact, bonds broke down to new annual lows the very next day, on Thursday, before coming to last week's end.

In this context, today is a good day for review of a price chart of the treasury long bond from an EchoVector Pivot Point Analysis Perspective for occurrences of possible price symmetries that may be forming within this past week's and months' context, and to review these symmetries' potential trading implications. This coming week is sure to be a significant week in the bond market.

In this analysis I will review two primary EchoVector Pivot Point Perspectives for their price symmetries and for their individual and combined trading implications.

The first echovector perspective is a four-year daily price action chart of the TLT which highlights a current key active presidential cycle echovector and a 'fan' of potential echo-extension vectors from a key presidential cycle echo-back-date, for context.

The second echovector perspective is a 2-year daily price action chart of the TLT which includes a currently active congressional cycle echovector which may be about to pivot, and on which I will be focusing, and several confirming shorter term cycle echovectors occurring in parallel also of interest.

I am using the TLT ETF and its price charts as a proxy for long bond treasuries market price action.

TLT ETF 4-YEAR DAILY OHLC

This first chart presents and highlights a key active 4-year presidential cycle echovector at work on Thursday 4/23/2103 along with that day's coordinate echo-back-date of Thursday 4/21/2009. Although many analysts were advancing the position of moving into bonds as a 'safety play' alternative against a possibly overheated stock market at this time, I was instead suggesting prudence and warning readers of a potential head-and-shoulders pattern in the making, and the wisdom of taking profits on the strong double-long swing trade opportunity alert I previously issued the week of March 11TH. This chart highlights the rather overall precarious nature of this year within the last phase of this cycle.

A longer term chart highlighting the 8-year regime change cycle clearly shows the lows of mid-March 2013 and its correlate lows in both 2009 and 2005, and active coordinate echovector support then each year. The regime change cycle chart also shows the symmetrical price extension levels following in the second quarter of each of those years, and indicates little price advantage going forward into the end either year; in fact, it reveals significant price fall each of those years instead. Illustrative charts regarding this additionally revealing analysis and context were posted on SeekingAlpha April 13TH, and can still be viewed there for a further long term framework for viewing this month's coming price action.

So far, the price behavior during this current phase of the presidential cycle is behaving consistently and coordinately subsumptive to the regime change cycle in which it occurs.

TLT ETF 2-YEAR DAILY OHLC

This second chart focuses on price activity and potentially revealing price symmetries occurring in the long bond the last two years.

Notice first that the active two year congressional cycle echovector for this past Thursday 8/1/2013 and its coordinate echo-back-date of Thursday 7/29/2012 is moving in significant parallel with the active presidential cycle echovector previously highlighted.

Note also in both 2011 and 2012 the following week presented strong pivot extension price pressure following The Fed's comments during the prior week. In 2011 the price reaction to Fed comments was strong price uplift that was also coordinate with presidential cycle uplift of similar basing in the lower price range in 2007. In 2012 the reaction was significant price down-pressure and price fall, prices having already rallied to the upper end of the active longer term echovector price range.

Also notice the current price momentum and slope symmetry in the bi-quarterly echovector (6 months, in solid aqua blue) for this year from Monday 7/22/2013 and coordinate echo-back-date Monday 1/22/2013, and the parallel active annual price echovector for this past week's Post Fed low (in spaced red).

Also note how relative coordinate price weakness followed well into the middle of the following month from the end of July last year, the end of January this year, and the end of July this year, and how this strong echovector slope and channel presently still appears intact.

This annual echovector price perspective and its price action might serve to argue as evidence for continued price down-pressure bias from a technical echovector perspective, even in the wake of both the active presidential cycle echovector's and the congressional cycle echovector's strong timing price up-biases going forward into this week in regard to potential weights on shorter term swing trading. We should begin to notice a key pivot in the congressional cycle echovector this week if these longer term echoes happen to become mitigated by nearer term annual price pressure, and contra-echoes begin to emerge. This week will prove very interesting.

CONCLUSIONS AND POSITIONING IMPLICATIONS

Remaining nimble is the key this week.

I've mentioned that I plan to look at opportunities to add to a short term swing trading position opened last week, but keeping my eye on the annual, bi-annual and extremely strong quarterly down-pressures, and possible continuations there, as well as for a failure in the echo and similar extension in the 2 year congressional cycle echovector that could result in its pivoting. I remain open to closing out my short term long in these events, and considering a position reversal. A breakout above an extension of the down-trending the aqua-blue bi-annual echovector highlighted which also reflects the slope of the active annual echovector for last week's price low would be reinforcing and bullish, but should be viewed within the context of the two presidential cycle echoing time and price length extension vectors going forward into the end of the year and the beginning of next year echoing within the presidential cycle and measured from this past spring's top.

However, regarding any longer term short positions that may still be open from that top, I would consider them primarily potentially mature, especially in the short term and at the current level of extension, and possibly at risk, and be ready to monitor them closely and test their cover within short term trading considerations.

I

f you believe the time has come to re-enter the treasury long bond, I suggest using active and adjustable straddling positions to manage your exposure to general price level changes in either direction. Setting advanced management straddles at key coordinate forecast levels is an effective and opportune measure, and advanced trade strategy I think prudent to mention. Such an approach to the bond market at this time could prove very valuable at engaging and effectively managing risk and reward.

One way to employ such a straddle would be to utilize the TLT ETF mentioned in this analysis by setting up an advanced trade technology approach (see "On-Off-Through Vector Target Price Switch") to positioning and position management, with appropriate dynamic triggers and stops included; for example, at $106.50 on the TLT.

To perform the short side of the straddle, set a short trigger below $106.50 on the TLT pre-programmed as a "repeating short trigger switch" at this trigger level on reverse downtick action through the trigger price, with stops set to activate on reverse uptick up-through action. To perform the long side of the straddle, set a long trigger above 106.50 pre-programmed as a "repeating long trigger switch" on reverse uptick action through the trigger, with stops set to activate on reverse downtick down-through action.

I'm hoping the EchoVector Pivot Point Analysis Perspectives provided in this article help lend additional context to your potentially already broad and extensive bond market view and analysis, and that they help you to further sharpen your clarity and insight. I always recommend considering a broad range of cosiderations, analysis and approaches when assessing the markets for any investment decision.

COLOR CODE GUIDE FOR CHARTS

1. Presidential Cycle EchoVector (4 Year): Long White

2. Congressional Cycle EchoVector (2 Year, Day of week): Yellow

3. Annual Cycle EchoVector (1 Year): Red

4. Bi-Quarterly Cycle EchoVector (6 Months): Blue

5. Quarterly Cycle EchoVector (3 Months): Grey

6. Select Support and/or Resistance Vectors and/or Related Price Extension Vectors (of Varied Lengths): Navy blue and/or Blue Purple

Thanks for reading. Good luck in your bond investing this week.

And, although the Fed has since attempted to mitigate its language and posture to indicate that purchasing will remain steady, the bond market has continued to weaken further. Investors have elected to continue their strong preference for rising stocks.

June remained poor for bond prices, seeing The TLT drop another 6 points from $114 to $108, and setting up an additional early July drop to nearly $106, before the damage to prices seemed to halt.

Many article's followed, with some analysts seeing bonds stabilizing, and again 'becoming a buy', while other analysts warned of continuing price weakness into the end of the year, and potentially beyond.

On balance, treasury long bond prices did stabilize through much of the remainder of July, finding continued technical support in this new price range. However, last week's mid-week FedSpeak activity apparently provided little additional support to bond prices; and, in fact, bonds broke down to new annual lows the very next day, on Thursday, before coming to last week's end.

In this context, today is a good day for review of a price chart of the treasury long bond from an EchoVector Pivot Point Analysis Perspective for occurrences of possible price symmetries that may be forming within this past week's and months' context, and to review these symmetries' potential trading implications. This coming week is sure to be a significant week in the bond market.

In this analysis I will review two primary EchoVector Pivot Point Perspectives for their price symmetries and for their individual and combined trading implications.

The first echovector perspective is a four-year daily price action chart of the TLT which highlights a current key active presidential cycle echovector and a 'fan' of potential echo-extension vectors from a key presidential cycle echo-back-date, for context.

The second echovector perspective is a 2-year daily price action chart of the TLT which includes a currently active congressional cycle echovector which may be about to pivot, and on which I will be focusing, and several confirming shorter term cycle echovectors occurring in parallel also of interest.

I am using the TLT ETF and its price charts as a proxy for long bond treasuries market price action.

TLT ETF 4-YEAR DAILY OHLC

This first chart presents and highlights a key active 4-year presidential cycle echovector at work on Thursday 4/23/2103 along with that day's coordinate echo-back-date of Thursday 4/21/2009. Although many analysts were advancing the position of moving into bonds as a 'safety play' alternative against a possibly overheated stock market at this time, I was instead suggesting prudence and warning readers of a potential head-and-shoulders pattern in the making, and the wisdom of taking profits on the strong double-long swing trade opportunity alert I previously issued the week of March 11TH. This chart highlights the rather overall precarious nature of this year within the last phase of this cycle.

A longer term chart highlighting the 8-year regime change cycle clearly shows the lows of mid-March 2013 and its correlate lows in both 2009 and 2005, and active coordinate echovector support then each year. The regime change cycle chart also shows the symmetrical price extension levels following in the second quarter of each of those years, and indicates little price advantage going forward into the end either year; in fact, it reveals significant price fall each of those years instead. Illustrative charts regarding this additionally revealing analysis and context were posted on SeekingAlpha April 13TH, and can still be viewed there for a further long term framework for viewing this month's coming price action.

So far, the price behavior during this current phase of the presidential cycle is behaving consistently and coordinately subsumptive to the regime change cycle in which it occurs.

TLT ETF 2-YEAR DAILY OHLC

This second chart focuses on price activity and potentially revealing price symmetries occurring in the long bond the last two years.

Notice first that the active two year congressional cycle echovector for this past Thursday 8/1/2013 and its coordinate echo-back-date of Thursday 7/29/2012 is moving in significant parallel with the active presidential cycle echovector previously highlighted.

Note also in both 2011 and 2012 the following week presented strong pivot extension price pressure following The Fed's comments during the prior week. In 2011 the price reaction to Fed comments was strong price uplift that was also coordinate with presidential cycle uplift of similar basing in the lower price range in 2007. In 2012 the reaction was significant price down-pressure and price fall, prices having already rallied to the upper end of the active longer term echovector price range.

Also notice the current price momentum and slope symmetry in the bi-quarterly echovector (6 months, in solid aqua blue) for this year from Monday 7/22/2013 and coordinate echo-back-date Monday 1/22/2013, and the parallel active annual price echovector for this past week's Post Fed low (in spaced red).

Also note how relative coordinate price weakness followed well into the middle of the following month from the end of July last year, the end of January this year, and the end of July this year, and how this strong echovector slope and channel presently still appears intact.

This annual echovector price perspective and its price action might serve to argue as evidence for continued price down-pressure bias from a technical echovector perspective, even in the wake of both the active presidential cycle echovector's and the congressional cycle echovector's strong timing price up-biases going forward into this week in regard to potential weights on shorter term swing trading. We should begin to notice a key pivot in the congressional cycle echovector this week if these longer term echoes happen to become mitigated by nearer term annual price pressure, and contra-echoes begin to emerge. This week will prove very interesting.

CONCLUSIONS AND POSITIONING IMPLICATIONS

Remaining nimble is the key this week.

I've mentioned that I plan to look at opportunities to add to a short term swing trading position opened last week, but keeping my eye on the annual, bi-annual and extremely strong quarterly down-pressures, and possible continuations there, as well as for a failure in the echo and similar extension in the 2 year congressional cycle echovector that could result in its pivoting. I remain open to closing out my short term long in these events, and considering a position reversal. A breakout above an extension of the down-trending the aqua-blue bi-annual echovector highlighted which also reflects the slope of the active annual echovector for last week's price low would be reinforcing and bullish, but should be viewed within the context of the two presidential cycle echoing time and price length extension vectors going forward into the end of the year and the beginning of next year echoing within the presidential cycle and measured from this past spring's top.

However, regarding any longer term short positions that may still be open from that top, I would consider them primarily potentially mature, especially in the short term and at the current level of extension, and possibly at risk, and be ready to monitor them closely and test their cover within short term trading considerations.

I

f you believe the time has come to re-enter the treasury long bond, I suggest using active and adjustable straddling positions to manage your exposure to general price level changes in either direction. Setting advanced management straddles at key coordinate forecast levels is an effective and opportune measure, and advanced trade strategy I think prudent to mention. Such an approach to the bond market at this time could prove very valuable at engaging and effectively managing risk and reward.

One way to employ such a straddle would be to utilize the TLT ETF mentioned in this analysis by setting up an advanced trade technology approach (see "On-Off-Through Vector Target Price Switch") to positioning and position management, with appropriate dynamic triggers and stops included; for example, at $106.50 on the TLT.

To perform the short side of the straddle, set a short trigger below $106.50 on the TLT pre-programmed as a "repeating short trigger switch" at this trigger level on reverse downtick action through the trigger price, with stops set to activate on reverse uptick up-through action. To perform the long side of the straddle, set a long trigger above 106.50 pre-programmed as a "repeating long trigger switch" on reverse uptick action through the trigger, with stops set to activate on reverse downtick down-through action.

I'm hoping the EchoVector Pivot Point Analysis Perspectives provided in this article help lend additional context to your potentially already broad and extensive bond market view and analysis, and that they help you to further sharpen your clarity and insight. I always recommend considering a broad range of cosiderations, analysis and approaches when assessing the markets for any investment decision.

COLOR CODE GUIDE FOR CHARTS

1. Presidential Cycle EchoVector (4 Year): Long White

2. Congressional Cycle EchoVector (2 Year, Day of week): Yellow

3. Annual Cycle EchoVector (1 Year): Red

4. Bi-Quarterly Cycle EchoVector (6 Months): Blue

5. Quarterly Cycle EchoVector (3 Months): Grey

6. Select Support and/or Resistance Vectors and/or Related Price Extension Vectors (of Varied Lengths): Navy blue and/or Blue Purple

Thanks for reading. Good luck in your bond investing this week.

Subscribe to:

Posts (Atom)