- Oct 2, 2013 2:12 AM | about stocks: AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLDX,GLL, IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ,DBS, SIL, SLVP, SIVR, SLV, USLV, DSLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH,UBG, UBM, USV, UGLD, DGLDECHOVECTORVEST - PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS - INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME."Positioning for change; staying ahead of the curve; we're keeping watch for you!"THE ECHOVECTORVEST MARKET PRICE PIVOTS FORECAST NEWSLETTERCurrently a regularly updated FREE online newsletter providing valuable and timely market price path analysis and price forecast charts, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOWINCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Irag/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/ Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

See Also Related Web Sites and Blog Sites:market-pivots.com, stock-pivots.com, dowpivots.com, spypivots.com,goldpivots.com, oilpivots.com, bondpivots.com,dollarpivots.com,currencypivots.com, commoditypivots.com,emergingmarketpivots.com, etfpivots.com, echovectorpivotpoints.com, andseekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest."For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."SCROLL DOWN TO VIEW THE ECHOVECTOR ANALYSIS CHARTS OF THE DAYDIRECT LINKS TO THIS MONTH'S SELECT TOPICS, ARTICLES, AND POSTS- Today Is An Important Day For Gold

on FRI, Aug 31 • GLD, IAU, GTU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Dow Heads To The Downside: It's Not Syria

on WED, Aug 28 • DIA, SPY, QQQ, IWM •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Will Silver's Upside Price Action Continue?

on THU, Aug 22 • SLV, GLD, NUGT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - As In Previous Quarters, This Is A Very Important Week In The Gold Market

on Wed, Aug 14 • GLD, NUGT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Is Silver Setting Up For Significant Upside Price Action This Month?

on Fri, Aug 9 • GLD, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective

on Wed, Aug 7 • DIA, IYM, SPY •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond

on Mon, Aug 5 • TLT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: Silver

on Wed, Jul 31 • SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

CURRENT POST

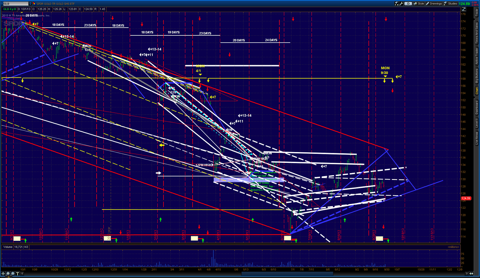

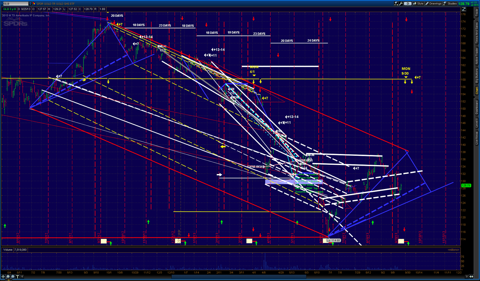

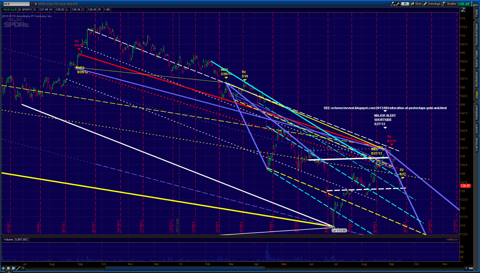

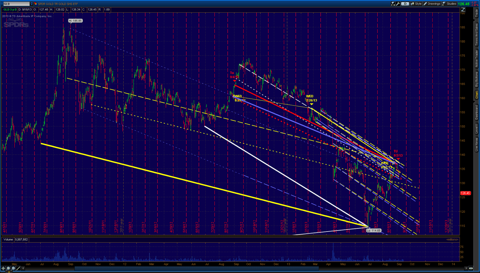

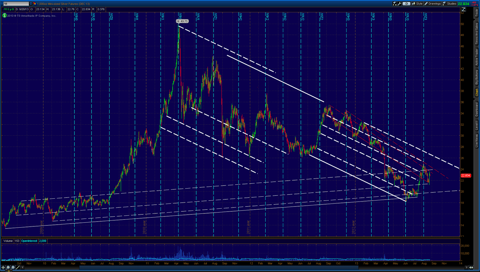

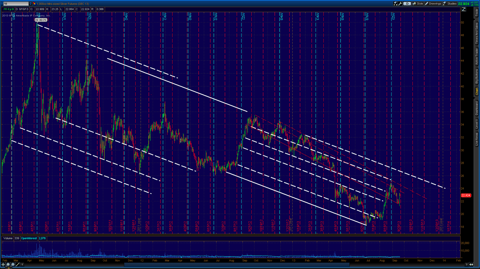

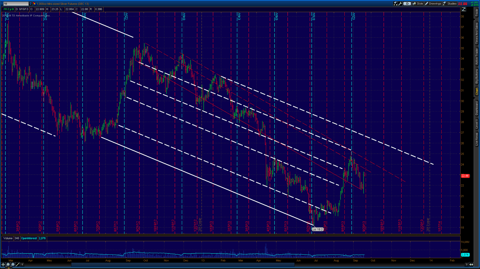

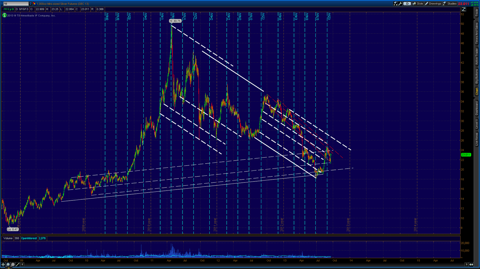

ANALYSIS, ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, AND COMMENTARYTuesday, October 1, 2013GOLDPIVOTS.COM: GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART UPDATE: WEDSDAY 2 OCTOBER 2013 210AM EDST(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)Monday, September 30, 2013GOLDPIVOTS.COM: GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART UPDATE: MONDAY 30 SEPTEMBER 2013 1107PM EDST(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)Wednesday, September 25, 2013GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART UPDATE AND ALERTTODAY'S TOMORROWWITH KEY ACTIVE ECHOVECTORS, COORDINATE FORECAST ECHOVECTORS, ECHOBACKDATES AND ECHOBACKTIMEPOINTS AND ECHOBACKPERIODS ILLUSTRATED AND HIGHLIGHTED1. QUARTERLY ECHOVECTOR: SHORTER WHITE2. BIQUARTERLY ECHOVECTOR: SHORTER YELLOW3. ANNUAL ECHOVECTOR: WHITE4. BI-ANNUAL (CONGRESSIONAL CYCLE): YELLOW5. KEY COORDINATE PRICE EXTENSION FRAMEVECTORS(ECHOVECTOR COORDINATED) AND TIMEPERIODS: BLUE-PURPLE(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)GLD ETF 1-YEAR DAILY OHLC____________________________________________________________________________________Thursday, September 19, 2013/GC GOLD FUTURES CONTRACT CAUTION AND ALERT: CURRENT BI-QUARTERLY ECHOVECTOR MOMENTUM VALUE IN /GC FUTURES CONTRACT AS OF CLOSE YESTERDAY AT 1365 IS STILL CONSISTENT WITH A FEBRUARY 2014 CONGRESSIONAL CYCLE ECHOVECTOR HIGH OF 1275____________________________________________________________________________________SEE ALSO: http://echovectorvest.blogspot.com/2013/09/gld-etf-echovector-pivot-points.htmlTuesday, September 17, 2013GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART UPDATE AND ALERTMonday, September 16, 2013GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART FROM 9/3/13 AND LAST MONTH'S ALERTThursday, September 5, 2013GOLDPIVOTS: GLD: ECHOVECTOR PIVOT POINTS MULTI-PERSPECTIVE FRAMECHARTS UPDATE SEE FRIDAY'S ALERT AND ARTICLE "Today Is An Important Day For Gold" AT seekingalpha.com/article/1666232-today-i...-goldGOLDPIVOTS: GLD: ECHOVECTOR PIVOT POINTS MULTI-PERSPECTIVE FRAMECHARTS UPDATESEE FRIDAY'S ALERT AND ARTICLE"Today Is An Important Day For Gold"TODAY'S TOMORROWMULTI-PERSPECTIVE ECHOVECTOR FRAMECHART UPDATEWITH KEY ACTIVE ECHOVECTORS ILLUSTRATED AND HIGHLIGHTED1. ANNUAL ECHOVECTOR: WHITE2. BI-ANNUAL (CONGRESSIONAL CYCLE): YELLOW(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)GLD ETF 1-YEAR DAILY OHLCGLD ETF 2-YEAR DAILY OHLCNo comments:Saturday, August 31, 2013GOLDPIVOTS AND SILVER PIVOTS: GLD AND SLV: Reiteration: Gold Analysis And Alert: The Current Importance of Today, And Of The Next 2 Weeks Going Into September's Primary Option's ExpirationFriday, August 30, 2013Gold is entering a critical technical period starting today, Friday August 30.A Head's Up Alert is being issued today.ANALYTICAL CONTEXTLooking at today's annual echobackdate (FRIDAY 8/31, 2012), we saw a surge in prices on Friday a year ago. From that surge we saw follow through the next week. that roughly equaled the Friday surge extension. In the week that followed we saw our final surge on Thursday that roughly equaled that same extension again,and proved to be our momentum top for the year. As was in 2011, options expiration in September in 2012 was our expiration high month.Yesterday we closed on the annual echovector that has constituted our options expiration's ladder steps up the last two months. this annual echovector runs from the Monday after primary options expiration Saturday in July 2012 to July 2013 and again from August 2012 to August 2013 on our climb for lows each (so far) year.This echovector is interestingly, also the same slope momentum as the 2 year echovector running from the September top in 2011 to this Week's top and which further interestingly runs through this past Tuesday's weekly top echo-back-date last year, 2012. This indicates to me this is a power symmetry price momentum echovector and should be a key to our present analysis.Should we not get the upside echo strength that occurred last year, a relative downward pivot in the annual echovechor, with a significant slope momentum differential will start to occur. This will show itself quickly tomorrow, and only become more enhanced the next two weeks, should no echo uplift occur. Non occurrence will put additional downside weight on gold prices.Note also the failure in gold after Options expiration going into the next quarter in both 2011 and 2012. This added weight only compounds downside technical weakness.SHORT SUMMARY1. Today is an important day regarding annual echovector strength and potential echovector downside pivoting if no echo-strength occurs.2. The next 2 weeks needs to see upside follow through or the annual echovector downside pivoting becomes dramatic.3. The Thursday before September's primary options expiration currently appears to be a primary as an apparent focus interest opportunity time-point short regardless of follow through and price level these next 2 week within the 2 year perspective.Silver Trader's may want to review their prior silver price history and/or silver charts for the potential of correlating applicable implications.Friday, August 30, 2013Today Is An Important Day For GoldToday Is An Important Day For GoldAug 30 2013, 07:04 | 2 comments | includes: GLDBOOKMARK / READ LATERDisclosure: I have no positions in any stocks mentioned, but may initiate a long position in GLD, NUGT, SLV over the next 72 hours. I may also instead open a short term swing trade short if we do not proceed with sufficient upside the next 3 trading days. (More...)Today is the end of August's trading, and August proved to be a very good month for gold. The gold metals based GLD ETF has rallied from a current annual low on June 28th, exactly two month ago, of under $115 on an intraday basis, to an impressive comeback price above $135 at yesterday's close: a solid gain of over 20 points, or 17%. Analysts are now debating whether or not gold is overbought, and if it will reverse its price course again, and continue back into its two year slide to lower lows, or if instead it is headed towards a longer-term rally from here? The $135 price level is an important technical price target.In addition to these impressive two months of gains and today being the close of the month of August and the beginning of a long and popular weekend in the U.S., the weekend is also overshadowed by significant international concerns in the Middle East. Syria remains front page news, the oil market is up strongly on possible Western military intervention in Syrian and related supply concerns, much of the commodity complex is following, and trader's additional favor for gold in such an international atmosphere would historically seem apparent.Also in Southwest Asia, India's currency is again being hard hit this week, and gold further attractiveness in that country, already had a strong commercial appetite for gold, is further appreciating. The euro is sliding again late this week also, which could stimulate additional gold buying interest there, along with the Syrian issue. Many analysts in the U.S. are concerned with the potential of a September stock market sell-off here, which could also stimulate additional gold buying interest here if stock market weakness from August does continue into historically seasonally weaker September, and a sell-off in stocks even accelerates. And September is right around the corner from today.These fundamental reasons makes today an important day for gold. Especially regarding the question of whether or not it can hold onto prices at or above the $135 level on the GLD.I also believe there are additional important technical considerations, from an EchoVector Analysis Perspective, that add particular importance and significance to today's trading in gold, especially with respect to September's overall price outlook. I will highlight these considerations on the following chart of the GLD ETF.(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)GLD ETF 2-YEAR DAILY OHLC ECHOVECTOR ANALYSIS PERSPECTIVELooking at the above chart, we can see that on today's echo-back-date one year ago, Friday, August 31, 2012), gold prices surge forward. From that surge we see that a good follow-through occurred the week that followed further lifting gold prices an equally impressive amount. And in the next following week, we again had a surge that lifted prices again that amount to levels which proved to be close to our upward momentum top for the year. This new price level, achieved over these weeks last year, carried forward into last September's primary options expiration weekend. The period from Friday August 31st last year to two weeks later into the close of September expiration proved very important to gold prices, and that strong Friday at the end of August was key.Additionally, we can also see that yesterday we closed on the annual echovector (dotted white) that constitutes the same active echovectors (solid white) for our preceding options expirations in August and July. Yesterday would be the third step up on that active echovector shown on the chart. This annual echovector runs from the Monday after primary options expiration in July 2012 to July 2013 and again from August 2012 to August 2013 in gold's climb from its prior lows two to three months earlier each year.This annual echovector is very significant also for the fact that it has the same slope momentum as the two-year echovector running from the 2011 September top to this week's top on Tuesday. It is also significant that this echovector runs through this past Tuesday's weekly echo-back-date top last year, before trading moved into that Friday, and its price surge. This further indicates how this echovector contains a powerful and currently active price symmetry momentum echovector slope and that it is key to our present echovector analysis.If we do not get the upside echo price strength that occurred last year today, a relative downward pivot in the annual echovector with a significant slope momentum force difference will start to occur. This will begin to show itself quickly today, and could only become more enhanced the next two weeks if gold prices fail to further sufficiently, or if they begin to falter altogether. This pivot would put additional downside weight on gold prices going forward. Also see the significant failure in gold prices after September options expiration in both 2011 and 2012. Added weight from a pivot in the annual echovector going into the next two weeks would only further weaken what appears to be a relative weak period coming up on an echovector basis after September expiration regardless.If positive gold price action does occur today, and good price-lift and follow-through from it occurs the next two weeks into September's options expiration consistent with price levels gains that occurred each of the last two years, then gold bulls may become satisfied. The more positively sloped two-year aqua-blue echovector would then manifest itself forward further from its Monday, July 22, confirmation from the June 28th low. The gold market has been on a trajectory consistent with this $147.50 GLD ETF price target since its late June low, but I believe it has some heavy lifting to do the next two weeks in order to achieve this target. This certainly makes today (and the next two weeks it sets up) important in the gold market.Thanks for reading. And good luck in your gold investing and trading.- Share this article with a colleague1

inShare1

BOOKMARK / READ LATERAbout this articleEmailed to: 305,023 people who get Macro View daily.Tagged: Macro View, Gold & Precious MetalsProblem with this article? Please tell us. Disagree with this article?Submit your own.More articles by Kevin Wilbur »- Dow Heads To The Downside: It's Not SyriaWed, Aug 28

- Will Silver's Upside Price Action Continue?Thu, Aug 22

- As In Previous Quarters, This Is A Very Important Week In The Gold MarketWed, Aug 14

- Is Silver Setting Up For Significant Upside Price Action This Month?Fri, Aug 9

- Could This Be A Correction That's Coming? An EchoVector Pivot Point PerspectiveWed, Aug 7

Thursday, September 5, 2013GOLDPIVOTS: GLD: ECHOVECTOR PIVOT POINTS MULTI-PERSPECTIVE FRAMECHARTS UPDATE SEE FRIDAY'S ALERT AND ARTICLE "Today Is An Important Day For Gold" AT seekingalpha.com/article/1666232-today-i...-goldGOLDPIVOTS: GLD: ECHOVECTOR PIVOT POINTS MULTI-PERSPECTIVE FRAMECHARTS UPDATESEE FRIDAY'S ALERT AND ARTICLE"Today Is An Important Day For Gold"TODAY'S TOMORROWMULTI-PERSPECTIVE ECHOVECTOR FRAMECHART UPDATEWITH KEY ACTIVE ECHOVECTORS ILLUSTRATED AND HIGHLIGHTED1. ANNUAL ECHOVECTOR: WHITE2. BI-ANNUAL (CONGRESSIONAL CYCLE): YELLOW(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)GLD ETF 1-YEAR DAILY OHLCGLD ETF 2-YEAR DAILY OHLC________________________________________________________________________Friday, September 20, 2013SILVER /YI FUTURES (SILVER SLV ETF) ECHOVECTOR FRAMECHART UPDATE: KEY ACTIVE 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR AND ANNUAL ECHOVECTOR, COORDINATE FORECAST ECHOVECTOR, AND ECHOBACKDATE ILLUSTRATION CHARTThursday, September 19, 2013: ALERTSILVER /YI FUTURES AND SILVER SLV ETF CAUTION: CURRENT ANNUAL ECHOVECTOR MOMENTUM VALUE IN SILVER /YI FUTURES CONTRACT AS OF CLOSE YESTERDAY AT 22.991 IS STILL CONSISTENT WITH A FEBRUARY 2014 CONGRESSIONAL CYCLE ECHOVECTOR HIGH OF 24.00 AND POTENTIAL HIGH BELOW 21.00Themes: Market Education, Futures, Federal Reserve, Market Currents,ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities, EchoVectorVEST,Technical Analysis, MDPP Precision Pivots Forecast Stocks: AGOL,DUST, FSG, GDX, GDXJ, GGGG, GLDX, GLL, IAU, NUGT, SGOL, TBAR, UGL,RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIVR, SLV,USLV, DSLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV, UGLD,DGLD - Today Is An Important Day For Gold

COMMODITYPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR COMMODITYPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.commoditypivots.com

CLICK HERE

THE COMMODITYPIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER IS A PUBLICATION OF

FOR CURRENT PREMIUM DESK ARTICLES , POSTS, ANALYSIS, COMMENTARY, ALERTS AND STRATEGY RELEASES FOR ALL MARKET ALPHA NEWSLETTERS GROUP PUBLICATIONS FOUND CURRENTLY FREE ONLINE AT THE GROUP'S CONSOLIDATED NEWSLETTER FREE ONLINE VERSION SITE

CLICK HERE COMMON

Click Here To View The Free Online Version Of The COMMODITYPIVOTS Forecaster, Including Timely EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots, Providing Key Market Intelligence And Technical Analysis For Active Advanced COMMODITIES MARKET Focused Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Related Indexes, ETFs, Options, Futures, And Other Securities!

DIRECT LINKS - RSS FEED POST UPDATES (INCLUDING COMMODITYPIVOTS.COM FREE ONLINE SECTOR COMPONENTS) BELOW: CLICK BELOW FOR DIRECT ACCESS TO THE MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASED EASYGUIDE TRADERS EDGE FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS NOW FREE ONLINE AT THE MARKET PIVOTS FORECASTER CONSOLIDATED ONLINE VERSION! CLICK ON LATEST POST TITLES IN THE RSS FEED PRESENTED BELOW:

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Is Presented As A Focus Sector Inclusion Of

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Also Includes The Free Online Content And Information For The Free Online Versions Of:

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

CLICK ON THE TITLES BELOW FOR THE LATEST POSTS OF

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Includes The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Presented As A Focus Sector Inclusion With Timely COMMODITIES MARKET Sector Related EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots And Providing Key Market Intelligence And Technical Analysis For Active Advanced Focused COMMODITIES MARKET Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Indexes, ETFs, Options, Futures, And Other Securities!

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

RSS LINK INTRO

THE MARKET ALPHA NEWSLETTERS GROUP'S NOW FREE ONLINE CONSOLIDATED VERSION'S (INCLUDING COMMODITYPIVOTS.COM) MOST RECENTLY GLOBALLY PUBLISHED POSTS TITLE LINKS APPEAR BELOW (DIRECT LINKS - RSS FEEDS UPDATED)

(CLICK ON TITLE LINKS PROVIDED BELOW TO ACCESS THIS MOST RECENT MARKET ALPHA NEWSLETTERS GROUP CONSOLIDATED VERSION POSTS, NOW FREE ONLINE, INCLUDING SELECT MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHARTS AND TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS - HIGHLIGHTED AND ILLUSTRATED UPDATES!)

EchoVectorVEST RSS FEED LAST 5 ENTRIES

ENLARGE

_________________________________________________________________________________

HOW TO ENLARGE ECHOVECTOR ANALYSIS CHART IMAGES BY ECHOVECTORVEST ON YOUR COMPUTER MONITOR'S DISPLAY_________________________________________________________________________________

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

Tuesday, 1 October 2013

GOLDPIVOTS.COM: GLD ETF ECHOVECTOR PIVOT POINTS FRAMECHART UPDATE: WEDSDAY 2 OCTOBER 2013 210AM EDST

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment