GOLDPIVOTS.COM: PARTIAL PREMIUM RELEASE FOR STUDY AND REVIEWECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART & OTAPS-PPS ACTIVE ADVANCED POSITION MANAGEMENT MODEL GUIDEMAP UPDATES: /GC GOLD METALS E-MINI FUTURESIN ASSOCIATION WITH MARKET-PIVOTS.COM AND E-MINIPIVOTS.COM AND COMMODITYPIVOTS.COM AND BRIGHTHOUSEPUBLISHING.COMMARKET ALPHA NEWSLETTER GROUP, AND MOTIONDYNAMICSANDPRECISIONPIVOTS.COMECHOVECTORVEST - PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS - INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME."Positioning for change; staying ahead of the curve; we're keeping watch for you!"THE MARKET PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERandTHE ETF PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERandTHE E-MINI FUTURES PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERin association withTHE ECHOVECTOR MARKET PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERFREE ONLINE VERSIONSCurrently regularly updated and FREE online version market newsletters providing valuable and timely market price path analysis and price forecast charts and potential price pivot timing indicators, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOWINCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Sri Lanka/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEARS 2013 OR 2014 ATNasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Financial RoundTable, Financial Board Central, Bullfax, BizWays, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Gold News Today, GoldPivots, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, Sterling Investment Services, Austin Rare Coins and Bullion, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, US Government Portal, Do It Yourself Investor, News Blogged, and others.See Also Related Web Sites and Blog Sites: e-minipivots.com, dowpivots.com, spypivots.com, qqqpivots.com,goldpivots.com, silverpivots.com, oilpivots.com, bondpivots.com,dollarpivots.com,currencypivots.com, commoditypivots.com,emergingmarketpivots.com, echovectorpivotpoints.com,"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."_____________________________________________SCROLL DOWN TO VIEW SELECT NEWSLETTERECHOVECTOR ANALYSIS FRAMECHARTSOF THE DAYECHOVECTOR PIVOT POINT PROJECTIONFRAMECHARTS AND ACTIVE ADVANCED MANAGEMENT OTAPS PRICE VECTOR POSITION POLARITY SWITCH SIGNAL PRICE GUIDE MAPSOF THE DAYCOORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS AND OTAPS POSITION POLARITY SWITCH SIGNAL PRICE GUIDE MAPSOF THE DAYADDITIONAL POSITION ALERTS AND OTAPS POSITION POLARITY SWITCH SIGNAL ALERTS AND STRATEGY NOTES OF THE DAYCOMMENTARY, ANALYSIS, OUTLOOK, ANDFOREWARD FORECASTSOF THE DAY__________________________________________________________

e-minipivots.com, dowpivots.com, spypivots.com, qqqpivots.com,goldpivots.com, silverpivots.com, oilpivots.com, bondpivots.com,dollarpivots.com,currencypivots.com, commoditypivots.com,emergingmarketpivots.com, echovectorpivotpoints.com,"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."_____________________________________________SCROLL DOWN TO VIEW SELECT NEWSLETTERECHOVECTOR ANALYSIS FRAMECHARTSOF THE DAYECHOVECTOR PIVOT POINT PROJECTIONFRAMECHARTS AND ACTIVE ADVANCED MANAGEMENT OTAPS PRICE VECTOR POSITION POLARITY SWITCH SIGNAL PRICE GUIDE MAPSOF THE DAYCOORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS AND OTAPS POSITION POLARITY SWITCH SIGNAL PRICE GUIDE MAPSOF THE DAYADDITIONAL POSITION ALERTS AND OTAPS POSITION POLARITY SWITCH SIGNAL ALERTS AND STRATEGY NOTES OF THE DAYCOMMENTARY, ANALYSIS, OUTLOOK, ANDFOREWARD FORECASTSOF THE DAY__________________________________________________________- DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

- Revisiting Gold: This Week's EchoVector Pivot Point Price Analysis And Advanced Position Management Approach For The Gold Metals Market: 1/12/14

on SUN, Jan 12 , 2014 • GLD, IAU, GTU, NUGT, SLV •PREMIUM ALPHA ARTICLE NOW GLOBALLY AVAILABLE - Don't Fight The Fed (Still Very Much In Force)

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE(First Published August, 2012) - Watch Out Gold

on THU, Sept 5, 2013• GLD, IAU, GTU, NUGT, SLV •PREMIUM ARTICLE NOW FREELY AVAILABLE GLOBALLY

- Today Is An Important Day For Gold

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Dow Heads To The Downside: It's Not Syria

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Will Silver's Upside Price Action Continue?

on THU, Aug 22, 2013 • SLV, GLD, NUGT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - As In Previous Quarters, This Is A Very Important Week In The Gold Market

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Is Silver Setting Up For Significant Upside Price Action This Month?

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond

on MON, Aug 5, 2013 • TLT, BOND •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: Silver

on WED, Jul 31, 2013 • SLV, AGOL, GLD •GLOBALLY PUBLISHED AND SYNDICATED ARTICLEGold Charts: Warning In February Still Valid Today

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Revisiting Gold: This Week's EchoVector Pivot Point Price Analysis And Advanced Position Management Approach For The Gold Metals Market: 1/12/14

______________________________________________________________________________________HOW TO ENLARGE ECHOVECTORVEST MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FRAMECHARTS AND FORECAST MODEL PRICE MAP IMAGES ON YOUR COMPUTER MONITOR'S DISPLAY1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.______________________________________________________________________________________CURRENT POSTWednesday, February 5, 2014 GOLDPIVOTS.COM & E-MINIPIVOTS.COM AND COMMODITYPIVOTS.COM AND MARKETPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 2/6/14: /GC E-MINI FUTURES PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERSThursday, January 30, 2014 GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: GLD ETF PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: GLD ETF PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERSBI-ANNUAL PERSPECTIVE 2-YEAR DAILY OHLC WITH KEY ACTIVE ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH CORRESPONDING ACTIVE ECHOVECTOR PIVOT POINT PROJECTIONS ILLUSTRATED AND HIGHLIGHTED: MARKET ALPHA BRAND NEWSLETTERS PUBLIC RELEASE UPDATE FROM DECEMBER 2013: RIGHT ON TARGET IN ASSOCIATION WITH MARKET-PIVOTS.COM AND ETFPIVOTS.COM

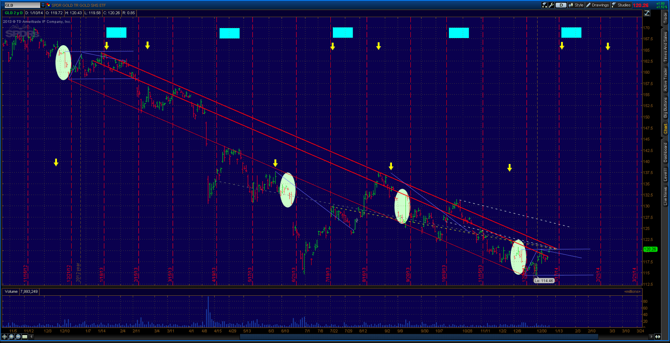

ANALYSIS, ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, AND COMMENTARYAND E-MINIPIVOTS.COM AND THE BRIGHTHOUSEPUBLISHING.COMMARKET ALPHA NEWSLETTER GROUP,AND MOTIONDYNAMICSANDPRECISIONPIVOTS.COMGLD ETF GOLD METALS ECHOVECTOR FRAMECHART AND TRADER'S EDGE OTAPS SIWTCH VECTORS PRICE GUIDEMAP UPDATESPREMIUM RELEASE PARTIAL PERSPECTIVES AND ANALYSIS TO ALPHA BRAND NEWSLETTERS FOR GENERAL PUBLIC PURVIEW -ECHOVECTORVEST MDPP PRECISION PIVOTS: 1/30/14: POWERFUL RESULTS: FORECAST RIGHT ON TARGET____________________________________________________________________PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS Sunday, January 26, 2014 GOLDPIVOTS.COM: GLD ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYIS FRAMECHART: EchoVector Analysis and EchoVector Pivot Point Price FrameChart and Trader's Edge OTAPS Position Polarity Switch Guidemap Update: Sunday 26 January 2014: Asian Monday Pre-market Open ______________________________________________________________PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERSTuesday, January 21, 2014 GTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYIS FRAMECHART: Week's End EchoVector Analysis FrameChart and EchoVector Pivot Point Price Trader's Edge GuideMap: 1-YEAR DAILY ANNUAL CYCLE OHLC PERSPECTIVE. ECHOVECTOR ANALYSIS RIGHT ON TARGET! UPDATE FOR TUESDAY 21 JANUARY 2014 AMERICAN MARKET CLOSE goldpivots.com and silverpivots.com and commoditypivots.com and currencypivots.com and market-pivots.com GTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYIS FRAMECHART AND TRADER'S EDGE PRICE GUIDEMAP UPDATE: Mid-Week EchoVector Analysis FrameChart and EchoVector Pivot Point Price GuideMap: ECHOVECTOR ANALYSIS RIGHT ON TARGET!READER'S BONUS CHART WEEK'S END UPDATEREADER'S BONUS CHARTS: RELATED TRADER'S EDGE PREMIUM VIEW RELEASE GTU ETF ECHOVECTOR ANALYSIS AND PERSPECTIVE GOLD METALS PROXY PRICE MAP AND GUIDECHARTGTU ETF GOLD METALS 1-YEAR DAILY OHLC CONGRESSIONAL CYCLE ECHOVECTOR ANALYSIS AND PERSPECTIVEWITH KEY CONGRESSIONAL CYCLE ECHOVECTOR (SOLID YELLOW)AND KEY COORDINATE ANNUAL CYCLE ECHOVECTORS (SOLID RED)AND KEY CORRESPONDING CONGRESSIONAL CYCLE COORDINATE FORECAST ECHOVECTORS S1 and R1 (DOTTED YELLOW) AND CORRESPONDING PIVOT POINT PRICE PROJECTION'SAND COORDINATE ECHOBACKDATE EXTENSION VECTORS (BLUE-PURPLE)HIGHLIGHTED AND ILLUSTRATEDPREMIUM RELEASE PARTIAL PERSPECTIVES AND ANALYSIS TO ALPHA BRAND NEWSLETTERS FOR GENERAL PUBLIC PURVIEW -

ECHOVECTORVEST MDPP PRECISION PIVOTS: 1/21/14: POWERFUL RESULTS: FORECAST RIGHT ON TARGET CLICK ON CHART(S) TO ENLARGE.

OPEN CHART(S) IN NEW TAB AND CLICK ON CHART(S) TO FURTHER ENLARGE AND ZOOM______________________________________________________________PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERSFriday, January 17, 2014GTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYIS FRAMECHART: Week's End EchoVector Analysis FrameChart and EchoVector Pivot Point Price Trader's Edge GuideMap: 2-Y DAILY CONGRESSIONAL CYCLE DAILY OHLC PERSPECTIVE. ECHOVECTOR ANALYSIS RIGHT ON TARGET! UPDATE FOR FRIDAY 17 JANUARY 2014 AMERICAN MARKET WEEK CLOSEgoldpivots.com and silverpivots.com and commoditypivots.com and currencypivots.com and market-pivots.comGTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYIS FRAMECHART AND TRADER'S EDGE PRICE GUIDEMAP UPDATE: Mid-Week EchoVector Analysis FrameChart and EchoVector Pivot Point Price GuideMap: ECHOVECTOR ANALYSIS RIGHT ON TARGET! READER'S BONUS CHART WEEK'S END UPDATEREADER'S BONUS CHARTS: RELATED TRADER'S EDGE PREMIUM VIEW RELEASE GTU ETF ECHOVECTOR ANALYSIS AND PERSPECTIVE GOLD METALS PROXY PRICE MAP AND GUIDECHARTGTU ETF GOLD METALS 1-YEAR DAILY OHLC CONGRESSIONAL CYCLE ECHOVECTOR ANALYSIS AND PERSPECTIVE WITH KEY CONGRESSIONAL CYCLE ECHOVECTOR (SOLID YELLOW)AND KEY COORDINATE ANNUAL CYCLE ECHOVECTORS (SOLID RED)AND KEY CORRESPONDING CONGRESSIONAL CYCLE COORDINATE FORECAST ECHOVECTORS S1 and R1 (DOTTED YELLOW) AND CORRESPONDING PIVOT POINT PRICE PROJECTION'SAND COORDINATE ECHOBACKDATE EXTENSION VECTORS (BLUE-PURPLE)HIGHLIGHTED AND ILLUSTRATEDPREMIUM RELEASE PARTIAL PERSPECTIVES AND ANALYSIS TO ALPHA BRAND NEWSLETTERS FOR GENERAL PUBLIC PURVIEW -

ECHOVECTORVEST MDPP PRECISION PIVOTS: 1/17/14: POWERFUL RESULTS: FORECAST RIGHT ON TARGET CLICK ON CHART(S) TO ENLARGE. ______________________________________________________________PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS: ARTICLE AND ANALYSISSunday, January 12, 2014GOLD METALS MARKET PREMIUM ARTICLE RELEASE: "Revisiting Gold: This Week's EchoVector Pivot Point Price Analysis And Position Management Approach For the Gold Metals Market: 1/12/14" PREMIUM ARTICLE RELEASE FOR ALPHA BRAND NEWSLETTER GROUP AND GLOBAL AVAILABILITYRevisiting Gold: This Week's EchoVector Pivot Point Price Analysis And Advanced Position Management Approach For The Gold Metals Market: 1/12/14The dramatic decline in gold prices since the fall of 2012 has been big news. Fortunately, in November of 2012 I alerted the gold market to what then was a cyclically important week in gold. The two weeks of trading that followed proved to be of great interest to participants worldwide. The price of gold fell significantly, trading down from around $160 on the GLD ETF to a low just below $151, a fall of over 5.5%.Then in late February of 2013, when gold was bouncing off a seeming near-term bottom, and many analyst where again filled with risk-on enthusiasm for the precious metal, I suggested that regardless of the price level at the time, a more prudent strategy likely was to enter gold closer to the end of June. See "Gold Chart: Price May Be Right, But Is Timing?"In May of 2013 I also put out a third article on gold titled, "Gold Charts:Warning In February Still Valid Today". In this article I warned that last year's then seasonal down-pressure was still likely not over. The wisdom of February's article had become fully apparent, with gold prices down another 20%, and the GLD falling near $131. In May's article I reiterated the importance of waiting patiently for the end of June to find a positive risk-reward re-entry time-point for gold, based on advanced echovector analysis. Another final leg down was forecast in May. As things ended up, it would have been hard for me, and the echovector analytical approach, to have been more correct, with gold falling further in 2013 to a closing low on the GLD the week of June 27TH below $116.As forecast, and warned, the first half of 2013 proved to be an historic sell-off in gold prices. My model had also indicated a strong seasonal buy signal at the end of June 2013 early on. And a bottom did come in on June 27TH, the week it was forecast-ed due, with notice of a possible bounce back to the $135 area into September, but with warning again going into the end of the year, which was also all published at my website, GOLDPIVOTS.com.This 2013 forecast has unfolded right on target. In August I reiterated notice of the possible bounce back to the $135 area into September, but also reiterated warnings that the risk-reward ratio to any such risk-on positions would begin to increase dramatically the week of September's primary options on an annual echovector perspective basis. I also presented analysis to this effect.On September 5TH of 2013, believing the better part of the season bounce was coming mature, I also published my article "Watch Out On Gold" alerting investors and trader's to specifics on how to interpret ensuing gold price motion mechanics, and when to exit the seasonal bounce using these, and when to reverse their short term longs back to shorts, and showed how nothing had changed regarding gold moving out of its "strong downward annual echovector momentum" that had been active into its low in the summer, and showed that these lows could easily be revisited before the year's end once again on an echovector analysis basis.On December 19TH 2013 I issued my final reversal Alert for 2013, calling for a bounce in gold into mid-January. I believed such a short-term bounce should be positioned into on a trading basis. But also positioned into because of the possibility that gold might find longer term Presidential Cycle EchoVector support in 2014, and that this support might not necessarily materialize at lower absolute price levels.As always, remaining nimble, alert, and using advanced OTAPS switching techniques (SeeOTAPS) would also be key to effective position management.A CURRENT LOOK AT THE CHARTSThe following chart updates my chart from both February and August 2013 on the GLD ETF illustrating how waiting until the end of June has been a very good annual risk-on risk-management strategy for gold since July 2009.The chart also indicates promise regarding a possible Presidential Cycle echo year in 2014 to its echobackyear of 2010 four years earlier, and how early February and late July/early August both proved to be significant inflection points in gold's price direction in 2010. The late July/early August inflection point also proved to be once again active and significant in 2012 within the subsumed and in phase Congressional Cycle within this Presidential Cycle. It has also continued to prove operant in each of the subsumed annual cycles within this Presidential Cycle as well.(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)The price of gold has started to shine again since The EchoVectorVEST MDPP Long Opportunity Alert the last week of December 2014 issued the week before Christmas. Many analyst are now asking if gold has seen its low for 2014 already, or if gold's downtrend the last two years will continue, and how positioning in gold should now be approached in light of this question. An updated echovector analysis of gold's price is particularly opportune this weekend in regard to answering this multi-faceted question involving (1) where may gold go from here in 2014, and (2) how we should 'position adjust' for gold's price path possibilities?Those who have been following the echovector model alerts and positioning in a manner consistent with its Double-Double leverage formulaic approach of this past year are extremely happy with 2013 outcomes, and they are also presently double-double long gold since the week before Christmas 2013 at the GLD ETF $114.55 price equivalency basis, on a major ECHOVECTORVEST MDPP PRECISION PIVOTS OTAPS* Strategy And Position Management Alert basis. Or they are even more aggressively (and even more profitably) long using ECHOVECTORVEST advanced derivatives management strategies.This is an important week in gold. So now may be a very good time to re-assess gold's near-term attractiveness and its eventual longer term potential standing within your portfolio. This week is particularly important for gold metals prices going forward into January's primary option expiration, and also going forward on into the three week's thereafter, from an EchoVector Analysis Perspective.Last year, as well as the last several quarters, the period following this quarterly option's expiration cycle did little in forwarding gold metals price levels, and actually proved quite precarious to prices into the first week of the following month, and in some instances, moreso even beyond.Because of this risk, the PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS forecast model is suggesting caution forward, and the application of advanced triggered OTAPS switching applications in current open position management. For context see the following chart. Corresponding analysis, strategy, and position management protocols are also discussed below.(Right click on the image of the chart to open in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)ECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE PRICE MAP AND GUIDECHARTGLD ETF GOLD METALS PROXY CHART 1-YEAR DAILY OHLC ANNUAL CYCLE ECHOVECTOR ANALYSIS AND PERSPECTIVEWITH TRI-QUARTER (GREY), BI-QUARTERLY (YELLOW) AND QUARTERLY (WHITE) EXTRAPOLATION ECHOBACK ECHOVECTORS (DOTTED) PROJECTED FROM CURRENT ANNUAL COORDINATE FORECAST ECHOVECTOR R1 PIVOT POINT PRICE PROJECTION'S UPPER THRESHOLD OTAPS RESISTANCE ALSO HIGHLIGHTED AND INCLUDEDNote in the chart above the horizontal blue-purple extension vectors running about 2 months worth of trading days long from the light green oval areas in December of 2013 and December of 2012. The lower horizontal price level and time period following December of each year represents the currently active lower threshold OTAPS* price level target switch, and theupper horizontal price level represents the upper threshold OTAPS price level target switch. Price movement up through the upper threshold generates a double-double open long at that trigger price and time. Price Movement down through the upper threshold closes any open long positions and generates a double-double open short position at that price and time. Directional tick is very important here. Effective directional tick switching can also be accomplished by setting the effective open and/or close trigger prices one cent on either side of the initial base target trigger price threshold.Additionally, movement down through the lower threshold OTAPS trigger switch closes any long positions that may otherwise be open, and generates a double-double open short position. Price movement up through the lower threshold switch will close any short position that may be open and generate a double-double long position open.Double-double leverage positions can be accomplished by utilizing highly liquid ULTRA ETF's on margin; or, if simply day-trading, utilizing full day-trading buying power (DTBP)on base proxy securities and ETFs. Using DTBP, however, prevents holding positions in full overnight, potentially leaving significant application holes within serious position management and risk management approaches and applied paradigms.Trader's more nimble may also remain attuned to price action analysis updates as we move forward through this time period, and to additional opportunities available for more nimble traders and investors, and those more adept and privy to ongoing and more zoomed price-scope based analysis and smaller and shorter cycle waves and echovector aggregations and compilations and their scope-relative echovector pivot point projections.Will the price of gold continue to shine, and gold break out above the $122.5 level on the GLD, and continue upward through the winter of 2014, and possibly beyond? Or will gold enthusiasm fizzle as prices reach Congressional Cycle price pressures, and begin to drop once again?Fundamental arguments for both scenarios are replete in this months journalism on gold, and each have been presented by many analyst the last several weeks. However, with applied echovector analysis and with the utilization and coordinate of advanced OTAPS position management strategies, both the active investor and the seasoned trader are ready to take advantage of either opportunity as it unfolds. This is accomplished with the application of intelligent echovector pivot point projection based bias timing in conjunction with the application of related and advanced OTAPS position management techniques.Thanks for reading. And good luck with your gold investing and trading.PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS"Positioning for change; staying ahead of the curve; we're keeping watch for you!"Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.READER'S BONUS CHARTS: RELATED TRADER'S EDGE PREMIUM VIEW RELEASE GTU ETF ECHOVECTOR ANALYSIS AND PERSPECTIVE GOLD METALS PROXY PRICE MAP AND GUIDECHARTGTU ETF GOLD METALS 2-YEAR DAILY OHLC CONGRESSIONAL CYCLE ECHOVECTOR ANALYSIS AND PERSPECTIVEWITH KEY CONGRESSIONAL CYCLE ECHOVECTOR (SOLID YELLOW)AND KEY COORDINATE ANNUAL CYCLE ECHOVECTORS (SOLID RED)AND KEY CORRESPONDING CONGRESSIONAL CYCLE COORDINATE FORECAST ECHOVECTORS S1 and R1 (DOTTED YELLOW) AND CORRESPONDING PIVOT POINT PRICE PROJECTION'SAND COORDINATE ECHOBACKDATE EXTENSION VECTORS (BLUE-PURPLE)HIGHLIGHTED AND ILLUSTRATEDECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE PRICE MAP AND GUIDECHARTGLD ETF GOLD METALS PROXY CHART 4-YEAR DAILY OHLC PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS AND PERSPECTIVEWITH KEY CONGRESSIONAL CYCLE ECHOVECTORS (SOLID YELLOW AND SOLID AQUA-BLUE)AND KEY ANNUAL CYCLE ECHOVECTORS (SHORT SOLID RED AND SHORT SOLID PINK)AND KEY PRESIDENTIAL CYCLE COORDINATE PIVOT POINT CLUSTER EXTENSION VECTORS (BLUE-PURPLE)

AND KEY ANNUAL CYCLE COORDINATE FLEX POINT EXTENSION VECTORS (GREEN)HIGHLIGHTED AND ILLUSTRATEDUPDATE OF GLD ETF PROXY GUIDECHART DISPLAYING SEASONAL EFFECT (SOLID GREEN EXTENSION VECTORS) FROM FEBRUARY 2013 AND MAY 2013 ARTICLESThis article is tagged with: Gold & Precious MetalsPosted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 10:47 PMNo comments:

Email ThisBlogThis!Share to TwitterShare to FacebookThemes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots ForecastStocks: GLD, GTU, AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLDX, GLL,IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ,DBS, SIL, SLVP, SIVR, SLV, USLV, DSLV, ZSL, WITE, DGP, DGZ, DZZ,SPGH, UBG, UBM, USV, UGLD, DGLD- DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

COMMODITYPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR COMMODITYPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.commoditypivots.com

CLICK HERE

THE COMMODITYPIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER IS A PUBLICATION OF

FOR CURRENT PREMIUM DESK ARTICLES , POSTS, ANALYSIS, COMMENTARY, ALERTS AND STRATEGY RELEASES FOR ALL MARKET ALPHA NEWSLETTERS GROUP PUBLICATIONS FOUND CURRENTLY FREE ONLINE AT THE GROUP'S CONSOLIDATED NEWSLETTER FREE ONLINE VERSION SITE

CLICK HERE COMMON

Click Here To View The Free Online Version Of The COMMODITYPIVOTS Forecaster, Including Timely EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots, Providing Key Market Intelligence And Technical Analysis For Active Advanced COMMODITIES MARKET Focused Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Related Indexes, ETFs, Options, Futures, And Other Securities!

DIRECT LINKS - RSS FEED POST UPDATES (INCLUDING COMMODITYPIVOTS.COM FREE ONLINE SECTOR COMPONENTS) BELOW: CLICK BELOW FOR DIRECT ACCESS TO THE MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASED EASYGUIDE TRADERS EDGE FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS NOW FREE ONLINE AT THE MARKET PIVOTS FORECASTER CONSOLIDATED ONLINE VERSION! CLICK ON LATEST POST TITLES IN THE RSS FEED PRESENTED BELOW:

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Is Presented As A Focus Sector Inclusion Of

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Also Includes The Free Online Content And Information For The Free Online Versions Of:

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

CLICK ON THE TITLES BELOW FOR THE LATEST POSTS OF

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

Which Includes The Free Online Version Of The COMMODITYPIVOTS Forecaster And Active Advanced Position And Risk Management Newsletter Presented As A Focus Sector Inclusion With Timely COMMODITIES MARKET Sector Related EasyGuide Traders Edge Focus Forecast FrameCharts And Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshots And Providing Key Market Intelligence And Technical Analysis For Active Advanced Focused COMMODITIES MARKET Daytraders, Swingtraders, Researchers, Analysts, Forecasters, Portfolio Managers, And Investors Involved In Indexes, ETFs, Options, Futures, And Other Securities!

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

RSS LINK INTRO

THE MARKET ALPHA NEWSLETTERS GROUP'S NOW FREE ONLINE CONSOLIDATED VERSION'S (INCLUDING COMMODITYPIVOTS.COM) MOST RECENTLY GLOBALLY PUBLISHED POSTS TITLE LINKS APPEAR BELOW (DIRECT LINKS - RSS FEEDS UPDATED)

(CLICK ON TITLE LINKS PROVIDED BELOW TO ACCESS THIS MOST RECENT MARKET ALPHA NEWSLETTERS GROUP CONSOLIDATED VERSION POSTS, NOW FREE ONLINE, INCLUDING SELECT MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHARTS AND TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS - HIGHLIGHTED AND ILLUSTRATED UPDATES!)

EchoVectorVEST RSS FEED LAST 5 ENTRIES

ENLARGE

_________________________________________________________________________________

HOW TO ENLARGE ECHOVECTOR ANALYSIS CHART IMAGES BY ECHOVECTORVEST ON YOUR COMPUTER MONITOR'S DISPLAY_________________________________________________________________________________

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

Wednesday, 5 February 2014

GOLDPIVOTS.COM & E-MINIPIVOTS.COM AND COMMODITYPIVOTS.COM AND MARKETPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 2/6/14: /GC E-MINI FUTURES PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment