"Positioning for change; staying ahead of the curve; we're keeping watch for you!"

THE MARKET PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE ETF PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE OPTION PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE E-MINI FUTURES PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

in association with

THE FINANCIAL MARKET ECHOVECTOR PIVOT POINT PRICE FORECASTER AND ADVANCED POSITION MANAGEMENT NEWSLETTER

FREE ONLINE VERSIONS

Currently regularly updated and FREE online version market newsletters providing valuable and timely market price path analysis and price forecast charts and potential price pivot timing indicators, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOW INCLUDE REGISTERED VIEWS FROM...

Afghanistan/ Argentina/ Australia/ Austria/ Bahamas/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Denmark/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/ Kazakhstan/ Korea/ Latvia/ Lithuania/ Luxembourg/ Malaysia/ Mexico/ Moldova/ Morocco/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Peru/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Sri Lanka/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Tunisia/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEARS 2013 OR 2014 AT

Nasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, Market Pivots Forecaster, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Market-Pivots, Financial RoundTable, Financial Board Central, Bullfax, BizWays, BizFeedz, StockFlash, MoneyShow, TradingView, Investor Hangout, StockPicksExpert, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Yahoo Finance Australia, Yahoo Finance New Zealand, Yahoo Finance Canada, Yahoo Finance Singapore, Gold News Today, GoldPivots, Casey Research, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, SBG Direct, Horizontal Metals, GoldSilverMoney, Sterling Investment Services, Prompto Capita, Silver Investor Weekly, Austin Rare Coins and Bullion, GoldPivots, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Gold Investor Weekly, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, SilverPivots, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, Skeptical Market Observer, Pension Plus, Fixed Income And Commodities, Collateral Finance Corporation, One Page News, EarthBlogNews, NewsFlashy, Veooz News, Wopular, Open Box Experiment, US Government Portal, Do It Yourself Investor, The Atlanta Journal Constitution, News Blogged, and others.

PROTECTVEST AND ADVANCEVEST

BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

METHODOLOGY NOTES

"EchoVector Theory and EchoVector Analysis assert that a securities prior price patterns may influence its present and future price patterns. Present and future price patterns may then, in part, be considered as 'echoing' these prior price patterns to some identifiable and measurable degree.

EchoVector Analysis is also used to forecast and project potential price Pivot Points (referred to as PPP's --potential pivot points, or EVPP's --EchoVector Pivot Points) and active, past and future coordinate forecast echovector support and resistance echovectors (SREV's) for a security from a starting reference price at a starting reference time, based on the securities prior price pattern within a given and significant and definable cyclical time frame.

EchoVector Pivot Points and EchoVector Support and Resistance Vectors are fundamental components of EchoVector Analysis. EchoVector SREV's are constructed from key components in the EchoVector Pivot Point Calculation. EchoVector SREV's are defined and calculated and also referred to as Coordinate Forecast EchoVectors (CFEV's) to the initial EchoVector (XEV) calculation and construction, where X designates not only the time length of the EchoVector XEV, but also the time length of XEV's CFEVs. The EchoVector Pivot Points are found as the endpoints of XEV's CFEVs' calculations and the CFEVs' constructions.

The EchoVector Pivot Point Calculation is a fundamentally different and more advanced calculation than the traditional pivot point calculation.

The EchoVector Pivot Point Calculation differs from traditional pivot point calculation by reflecting this given and specified cyclical price pattern length and reference, and its significance and information, within the pivot point calculation. This cyclical price pattern and reference is included in the calculations and constructions of the echovector and its respective coordinate forecast echovectors, as well as in the calculation of the related echovector pivot points.

While a traditional pivot point calculation may use simple price averages of prior price highs, lows and closes indifferent to their sequence in time to calculate its set of support and resistance levels, the echovector pivot point calculation begins with any starting time and price point and respective cyclical time frame reference X, and then identifies the corresponding "Echo-Back-Date-Time-And-Price-Point (EBD-TPP)" within this cyclical time frame reference coordinate to the starting reference price and time point A. It then calculates the echovector (XEV) generated by the starting reference time/price point and the echo-back-date-time-and-price-point, and includes the pre-determined and pre-defined accompanying constellation of "Coordinate Forecast EchoVector" origins derived from the prior price pattern evidenced around the echo-back-date-time-and-price-point (EBD-TPP) within a certain pre-selected and specified range (time and/or price version) that occurred within the particular referenced cyclical time-frame and period X. The projected scope-relative EchoVector Pivot Points, the EVPPs (PPPs) that follow Security I's starting point A of EchoVector XEV, of designated cycle time length X , are then calculated and constructed using the EBD-TPP and its scope-relative nearby pivot points and inflection points (NPPs-NFPs), and by the corresponding echovector slope momentum rate indicator shared by both the original echovector and its coordinate forecast echovectors within the fundamental forecast echovector pivot point price parallelogram construction, and by the support and resistance levels and the slope momentum indicator determined by XEV and by the included coordinate forecast echovectors (they also fully utilizing the time-sequence and already occurring NPP-NFP prices to A's EBD-TPP, and the constellation of CFEV origins produced).

EchoVector Pivot Points are therefore advanced and fluid calculations and effective endpoints of projected coordinate forecast echovector support and resistance time/price levels, projections that are constructed from and follow in time from the starting reference price, time/price point A (echovector endpoint) of the initial subject focus echovector construction, and which occur within an EchoVector Pivot Point Price Projection Parallelogram construct: levels which are derived from coordinate (support and/or resistance) forecast echovectors calculated from particular 'scope and range defined' starting times and price points reflecting the time and price points of proximate scale and scope and time/price pivoting action that followed the initial subject focus interest echovector's echo-back-date-time-and-price-point B (derived from and relative to the initial subject focus echovector's starting time-point and price-point A, and the echovector's given and specified cyclically-based focus interest time-span X, and the initial subject focus echovector's subsequently derived slope relative momentum measures).

The EchoVector Support and Resistance Vectors, referred to as the Coordinate Forecast Echovectors, are used to generate the EchoVector Pivot Points."

From "Introduction to EchoVector Analysis And EchoVector Pivot Points"COPYRIGHT 2013 ECHOVECTORVEST MDPP PRECISION PIVOTS

DEFINITION: THE ECHOVECTOR

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

PROTECTVEST AND ADVANCEVEST

ECHOVECTOR ANALYSIS

ILLUSTRATION FRAMECHARTS

AND ECHOVECTOR PIVOT POINT PROJECTION

ILLUSTRATION FRAMECHARTS

OF THE DAY

PROTECTVEST AND ADVANCEVEST

MDPP PRECISION PIVOTS

ACTIVE ADVANCED MANAGEMENT

OTAPS-PPS POSITION POLARITY

OPEN, COVER, AND SWITCH SIGNAL VECTOR

TIME/PRICE ILLUSTRATION GUIDEMAPS

OF THE DAY

PROTECTVEST AND ADVANCEVEST

KEY CYCLICAL ECHOVECTOR

AND COORDINATE FORECAST ECHOVECTOR

PIVOT POINT PROJECTION

ILLUSTRATION FRAMECHARTS

WITH OTAPS-PPS POSITION POLARITY

SWITCH SIGNAL

TIME/PRICE VECTOR

ILLUSTRATION GUIDEMAPS

OF THE DAY

PROTECTVEST AND ADVANCEVEST

POSITION ALERTS AND

OTAPS-PPS POSITION POLARITY

SWITCH SIGNAL ALERTS

AND RELATED STRATEGY NOTES

OF THE DAY

POSITION ALERTS AND

OTAPS-PPS POSITION POLARITY

SWITCH SIGNAL ALERTS

AND RELATED STRATEGY NOTES

OF THE DAY

PROTECTVEST AND ADVANCEVEST

(SCROLL DOWN PAST THE FOLLOWING DIRECT LINKS TO SELECT ARTICLES AND POSTS

AND PAST THIS MONTH'S ARCHIVE LIST OF POSTS

TO VIEW TODAY'S CURRENT POSTS)

ANALYSIS, OUTLOOKS,

FORWARD FORECASTS,

AND COMMENTARIES

ON COMING AND SELECT MARKET

FOCUS INTEREST OPPORTUNITIES

(SCROLL DOWN PAST THE FOLLOWING DIRECT LINKS TO SELECT ARTICLES AND POSTS

AND PAST THIS MONTH'S ARCHIVE LIST OF POSTS

TO VIEW TODAY'S CURRENT POSTS)

on Sat, Aug 2, 2014,

• GLD, GTU, IAU, NUGT, GOLD, DUST, UGLD, DGLD, AGOL, FSG, GDX, GDXJ, GGGG, GLDX, GLL, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIRV, SLV, USLV, DSLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKETNOW FREELY AVAILABLE GLOBALLY

on Sat, Aug 2, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Sat, Aug 2, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Fri, Aug 1, 2014,

• EEM, SCHE, EEMA,EMHY, GMM, EEB, EWX, GMF, BIK, ESR, EWH, YXI, FXP, XPP, PEK, FXI •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKETNOW FREELY AVAILABLE GLOBALLY

on Fri, Aug 1, 2014,

• DIA, DJX, DJI, DOG, DDM, DXD, DZZ, /YM, SPY, SPX, IVV, IXIC, SSO, SDS, SPXU, SPLV, /ES, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, /NQ, IWM, RWM, UWM, UKK, TWM, /RJ, VXX, UVXY, XIV, TVIX, XLI, TNA •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKETNOW FREELY AVAILABLE GLOBALLY

on Fri, Aug 1, 2014,

• TLT, BOND, TBT, LQD, HYG, PLW, TMV, FSE, FSA, DLBS, DLBL, VGLT, LTPZ, ZROZ, TIPZ, TRSY, LBND, SBND, WIP, TLO, AGG, LWC •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Thur, July 31, 2014,

• DIA, DJX, DJI, DOG, DDM, DXD, DZZ, /YM, SPY, SPX, IVV, IXIC, SSO, SDS, SPXU, SPLV, /ES, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, /NQ, IWM, RWM, UWM, UKK, TWM, /RJ, VXX, UVXY, XIV, TVIX, XLI, TNA•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Sat, July 26, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Fri, July 18, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Thu, July 17, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Wed, July 16, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Tues, July 8, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Mon, July 7, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

POWERFUL ALERT RESULTS: GOLD METALS MARKET: GLD ETF: Forecast Right On Target: Major Long Bias Alert Issued On June 17TH Is Followed By Powerful Upside Move In Gold Metals Market: Active Advanced Management OTAPS-PPS MDPP PRECISION PIVOTS Model Double-Double And Derivatives Level Strategies Prove Highly Timely

on Tues, June 19, 2014,

• GLD, IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP KEY ALERT SUMMARY RELEASE FOR THE PRECIOUS METALS

NOW FREELY AVAILABLE GLOBALLY

on Thurs, June 19, 2014,

• TLT, BOND, TBT, LQD, HYG, PLW, TMV, FSE, FSA, DLBS, DLBL, VGLT, LTPZ, ZROZ, TIPZ, TRSY, LBND, SBND, WIP, TLO, AGG, LWC •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LONG BOND TREASURIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Wed, June 18, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC•

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Tues, June 17, 2014,

• GLD, IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP KEY ALERT SUMMARY RELEASE FOR THE PRECIOUS METALS

NOW FREELY AVAILABLE GLOBALLY

on Wed, May 7, 2014,

• GLD, IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP KEY ALERT SUMMARY RELEASE FOR THE PRECIOUS METALS

NOW FREELY AVAILABLE GLOBALLY

on Sat, Apr 22, 2014,

• GLD IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RESULTS RELEASE FOR THE PRECIOUS METALS NOW FREELY AVAILABLE GLOBALLY

on Sat, Apr 26, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Fri, Apr 25, 2014,

• GLD IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RESULTS RELEASE FOR THE PRECIOUS METALS NOW FREELY AVAILABLE GLOBALLY

on Fri, Apr 25, 2014,

• USO, USL, DNO, UCO, SCO, OIH, DDG, OIL, OILZ, DTO, OLO, SZO, IOIL, BNO, DUG, CRUD, YYY, FOL, OLEM, BARL, TWTI, FRAK, XLE •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RESULTS RELEASE FOR THE WTI CRUDE OIL MARKET NOW FREELY AVAILABLE GLOBALLY

on Fri, Apr 25, 2014,

• TLT, BOND, TBT, LQD, HYG, PLW, TMV, FSE, FSA, DLBS, DLBL, VGLT, LTPZ, ZROZ, TIPZ, TRSY, LBND, SBND, WIP, TLO, AGG, LWC •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RESULTS RELEASE FOR THE LONG BOND TREASURIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Fri, Apr 25, 2014,

• DIA, SPY, QQQ, PSQ, QLD, QID, TQQQ, SQQQ, SPLV, SPXU, SSO, SDS, DOG, DDM, DXD, DZZ, DJX, DJI, SPX, IXIC •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RESULTS RELEASE FOR THE LARGE CAP EQUITIES MARKET NOW FREELY AVAILABLE GLOBALLY

on Mon, Apr 14, 2014,

• GLD IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RELEASE FOR THE PRECIOUS METALS

NOW FREELY AVAILABLE GLOBALLY

on Mon, Mar 31, 2014,

• GLD IAU, GTU, NUGT, SLV •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ALERT RELEASE FOR THE PRECIOUS METALS

NOW FREELY AVAILABLE GLOBALLY

on Thu, Mar 27, 2014,

• TLT, TBT, LQD, HYG, BOND, GOVT, /ZB, /ZN, •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ARTICLE AND ANALYSIS RELEASE

NOW FREELY AVAILABLE GLOBALLY

on Wed, Mar 26, 2014,

• TLT, TBT, LQD, HYG, BOND, GOVT, /ZB, /ZN, •

PREMIUM DESK MARKET ALPHA BRAND NEWSLETTER GROUP ARTICLE AND ANALYSIS RELEASE

NOW FREELY AVAILABLE GLOBALLY

Treasury Long Bond Cycles And Current Price Resistance Levels,

And Fed Chairman Yellen's Recent Comment On The Interest Rate Hike Time Table

on MON, Mar 24 , 2014 • TLT, TBT, BOND, GOVT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on FRI, Mar 2, 2014,

• SPX, SPY, IYM, DJX, DJI, DIA, QQQ, IWM •

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE AND

BENZINGA GLOBAL REACH ARTICLE NOW FREELY AVAILABLE GLOBALLY

on SUN, Mar 2, 2014,

• SLV, GLD, IAU, GTU, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Feb 26, 2014, With THU Update

• GLD IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Feb 25, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on TUES, Feb 25, 2014, w/ FRI UPDATE • GLD, GTU, NUGT •

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on , Jan 12, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

(First Published August, 2012)

on THU, Sept 1, 2013 * GLD, IAU, GTU, NUGT, SLV *

PREMIUM MARKET ALPHA NEWSLETTERS GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on THU, Aug 22, 2013 • SLV, GLD, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, Aug 5, 2013 • TLT, BOND •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Jul 31, 2013 • SLV, AGOL, GLD •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

Newsletter Archive - Click Selected Post And Scroll For FrameCharts And/Or OTAPS-PPS Price Targets

- ▼ 2014 (631)

- ▼ August (18)

- GLD OTAPS WITH LFOUR OTAPS 123.90 RIGHT ON TARGET

- GOLDINVESTORWEEKLY.COM BY GOLDPIVOTS.COM: GOLD AND...

- GLD ETF GOLD METALS MARKET ECHOVECTOR ANALYSIS FRA...

- SPY ETF ECHOVECTOR ANALYSIS FRAMECHART UPDATES: K...

- DIA ETF AND SPY ETF: THIS PAST THURSDAY'S PRICE AC...

- UUP OTAPS WITH LFOUR OTAPS 21.75

- TLT OTAPS WITH LFOUR OTAPS 114.50

- GLD OTAPS WITH LFOUR OTAPS 124.50 RIGHT ON TARGET

- DIA OTAPS WITH LFOUR OTAPS 164. 95 WITH INTRADAY S...

- DIA OTAPS WITH LFOUR OTAPS 164.30 WITH INTRADAY ST...

- DIA ETF & SPY ETF: US LARGE CAP EQUITIES COMPOSITE...

- EMERGING MARKETS WATCH AND FOREWARD ALERT: BIAS FO...

- LONG BOND WATCH AND FORWARD ALERT: ECHOVECTOR LOG...

- GLD OTAPS WITH LFOUR OTAPS 123.50 RIGHT ON TARGET

- USO OTAPS WITH LFOUR OTAPS 36.05 RIGHT ON TARGET

- DIA OTAPS WITH LFOUR OTAPS 165.40 WITH INTRADAY ST...

- DIA OTAPS WITH LFOUR OTAPS 164.75 WITH INTRADAY ST...

- WEEK 31 2014: THIS WEEK'S LARGE CAP EQUITIES ECHOV...

- ▼ August (18)

HOW TO ENLARGE FRAMECHARTS AND PRICE MAPS

______________________________________________________________________________________

HOW TO ENLARGE ECHOVECTORVEST MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FRAMECHARTS AND FORECAST MODEL PRICE MAP IMAGES ON YOUR COMPUTER MONITOR'S DISPLAY

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

______________________________________________________________________________________

Sunday, August 3, 2014

GOLDINVESTORWEEKLY.COM BY GOLDPIVOTS.COM: GOLD AND SILVER METALS MARKET ARTICLE: MDPP PRECISION PIVOTS PREMIUM RELEASE: MINING THE MARKET PRICE PATH MOTIONS OF GOLD: NOW FREE ONLINE: Gold Metals Market Watch: GLD ETF Proxy Instrument: Current EchoVector Pivot Point Analysis Perspective And Forecast Trade Opportunity Scenario and Strategy Setup For August 2014 Week 32: Base Double-Double Ultras Signal Approach and Advanced Derivatives Strategy Signal Approach Compliments: EchoVector Analysis Active Advanced Position Management Trader's Edge EchoVector Pivot Point Signal Forecast FrameCharts And Price Path GuideMaps With OTAPS-PPS Position Polarity Open/Cover/And Switch Signal Time-Price Extension Vectors Included: PROXY GLD ETF ECHOVECTOR FRAMECHARTS AND GUIDEMAPS -- POTENTIALLY IMPACTED RELATED INSTRUMENT SYMBOLS (NON COMPREHENSIVE) LIST -- GTU, AGOL, DUST, FSG, GDX, GDXJ, GGGG, GLDX, GLL, IAU, NUGT, SGOL, TBAR, UGL, RING, DBB, DBP, GLTR, PSAU, XME, AGQ, DBS, SIL, SLVP, SIVR, SLV, USLV, DSLV, ZSL, WITE, DGP, DGZ, DZZ, SPGH, UBG, UBM, USV, UGLD, DGLD

MDPP PRECISION PIVOTS: MINING THE MOTION: Gold Metals Market Watch: GLD ETF Proxy Instrument: Current EchoVector Pivot Point Analysis Perspective And Forecast Trade Opportunity Scenario and Strategy Setup For August 2014 Week 32: Base Double-Double Ultras Signal Approach and Advanced Derivatives Strategy Signal Approach Compliments: EchoVector Analysis Active Advanced Position Management Trader's Edge Signal FrameCharts And Price Path GuideMaps With OTAPS-PPS Position Polarity Open/Cover/And Switch Signal Time-Price Extension Vectors Included

"As In Previous Quarters, This Is A Very Important Week In the Gold Market"

The approaching week's echovector pivot point strength does not end with the annual echovector either. EchoVector Pivot Point Strength in the bi-quarterly cycle echovector (2QEV), the annual cycle echovector (AEV), the 2-year congressional cycle echovector (CCEV), and the 4-year presidential cycle echovector (PCEV) all converge. This could be considered quite technically positive for the potential for price lift forward.

The shorter quarterly cycle echovector (QEV), however, provides little support to lift, and the monthly cycle echovector (MEV) actually countervails lift. So stops are particularly warranted among venturing long side risk-on position potential pursuers..

How the longer term time cycle echovector pivot point price projection strengths play out against the relative weakness in the shorter term cycle echovectors, particularly right after key monthly options expiration, will be very interesting in its impact on the formation of price momentum levels and subsequent price echovector weights and tracks for the second half of this year, and well into next year too.

At this key time, as we enter what is typically the beginning of seasonal price strength in gold, my suggestion is to remain nimble, and be ready to take advantage of cyclical echovector pivot point long opportunities as well as potential echovector pivot point short opportunities, while also remaining protected with stops. And, to the more advanced trader, I would suggest even being tactically ready, in the event of relative counter-cyclical occurrences, to have order protocols already constructed and inputted that would readily trigger position polarity reversals as market price action dictated.

ABREVIATED VERSION

(click to enlarge)

(click to enlarge)

(click to enlarge)

Kevin Wilbur, Chief Market Strategist And Senior EchoVector Analysis Methodologist

Market Alpha Brand Newsletters Group, PROTECTVEST AND ADVANCVEST

Saturday, August 2, 2014

Saturday, August 2, 2014

ARTICLE SUMMARY

- Both the month of August and this coming week in the month of August are very important periods cyclically this year in the gold metals market.

- Technical support in the gold metals market in the significant 4-Year Presidential Cycle EchoVector, and in the 2-Year Congressional Cycle EchoVector, and in the Annual Cycle EchoVector, and in the 6-Month Bi-Quarterly Cycle EchoVector all converge this coming week.

- Technical support and price lift the second half of this year are important. Especially in further constructing this year as a basing year. Without sufficient price support and seasonal price lift this year the 4-Year Presidential Cycle Price Momentum EchoVector could easily pivot clockwise into negative slope momentum adding further downward technical weight and price pressure to the gold metals market.

- The historically stronger period of seasonal support within the annual cycle of gold and silver prices is about to begin. It, along with a perceived overbought stock market prices and potential looming correction, added to recently announced further Fed Bond Purchase Tapering, may lead some sidelined gold and silver traders to again re-consider potential prospects for additional risk-on positions in gold and silver.

- The shorter Quarterly EchoVector and Monthly EchoVector both add little support to gold prices and price lift at this juncture, so stops are particularly warranted in risk-on positions.

ARTICLE

BACKGROUND

The month of August is a particularly important month in the gold and silver metals markets on a technical echovector pivot point price analysis basis. Gold and silver metals prices have been basing this year after significant price declines last year from their lofty 2ND-half year 2011 and 2012 prices. Many gold and silver bulls are hoping this year's relative price action is setting the stage for a return to the trend of year-over-year price gains, and are looking positively towards this month as what is historically the beginning of 2ND-half year seasonal price strength to support their aspirations for stronger gold and silver prices forward. Looking back at a chart of prices throughout this presidential cycle week can find this repeating occurance. To view a chart highlighting this August effect and read further discussion, see to last year's timely August article,

This week also marks the anniversary of a very prescient set of article's I wrote on this subject in the summer of 2013. In these articles I focused on a cyclical price momentum echovector pivot point price projection framecharts from an EchoVector Price Analysis Perspective reviewing them for the possible occurrences of annual price symmetries that might be forming, and these formation's potential trading implications forward. This year the gold and silver metals markets are setting up once again for an important August month, and this coming week's coming price action appears in focus as particularly significant.

TECHNICALS: A LOOK AT THE CHARTS

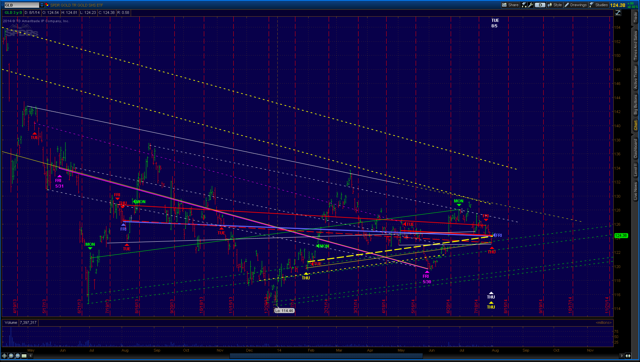

The following GLD ETF EchoVector Pivot Point Price Analysis Framechart reveals very interesting recent price action. It highlights how the annual time cycle price momentum echovector recently pivoted clockwise, from positive to negative slope rate directional momentum (the longer solid white line compared to the longer solid red line that begin later and is highlighted in this chart). However, also note how this past Friday's "closing price annual cycle price momentum echovector (AEV)" is pivoting counter-clockwise back again from these previously "clockwise pivoting" momentum echovector slope rates, at the margin. This can be seen in the next solid white annual echovector, that follows the previous two mentioned, also reading along time from left to right.

A forecast scenario opportunity for short-term long positioning uplift in the first half of this coming week may soon become apparent and timely, particularly on the annual echovector basis. Note also how the solid yellow bi-quarterly echovector (in solid yellow) also currently supports this thesis as well.

The shorter quarterly cycle echovector (QEV), however, provides little support to lift, and the monthly cycle echovector (MEV) actually countervails lift. So stops are particularly warranted among venturing long side risk-on position potential pursuers..

How the longer term time cycle echovector pivot point price projection strengths play out against the relative weakness in the shorter term cycle echovectors, particularly right after key monthly options expiration, will be very interesting in its impact on the formation of price momentum levels and subsequent price echovector weights and tracks for the second half of this year, and well into next year too.

1-YEAR DAILY OHLC

ANNUAL CYCLE PRICE ECHOVECTOR PIVOT POINT PROJECTON ANALYSIS FRAMECHART FOCUS PERSPECTIVE

AND TRADER'S EDGE OTAPS-PPS PRICE GUIDEMAP HIGHLIGHTS

2-YEAR DAILY OHLC

CONGRESSIONAL CYCLE PRICE ECHOVECTOR PIVOT POINT PROJECTON ANALYSIS FRAMECHART FOCUS PERSPECTIVE

AND TRADER'S EDGE OTAPS-PPS PRICE GUIDEMAP HIGHLIGHTS

4-YEAR DAILY OHLC

CONGRESSIONAL CYCLE PRICE ECHOVECTOR PIVOT POINT PROJECTON ANALYSIS FRAMECHART FOCUS PERSPECTIVE

AND TRADER'S EDGE OTAPS-PPS PRICE GUIDEMAP HIGHLIGHTS

ADDITIONAL FRAMECHART FOOTNOTES AND OBSERVATIONS

GLD ETF ANNUAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The longer solid yellow lines are bi-annual echovectors and the longer solid red, green, pink and blue-purple are annual echovectors. The shorter solid yellow lines are bi-quarterly echovectors. Notice the price updraft that follows next week well into August Options Expiration Week (3RD Trading Week of August) for both the annual echovector and the bi-quarterly echovectors.

_______________________________________________________________________

GLD ETF 2-YEAR CONGRESSIONAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The longer solid yellow echovectors are 2-year congressional cycle echovectors, and the solid red, green, pink and blue-purple lines that are half as long are annual echovectors . Notice that the price updraft that follows next week well into August Options Expiration Week (3RD Trading Week of August) for both the annual echovector and the bi-quarterly echovectors also occurs in the 2-year congressional cycle echovector. Also notice that both the key "end of May" 1-year pink annual cycle price momentum echovector and "end of May" 2-year yellow congressional cycle price momentum echovector key are both parallel and overlap and their echobackdates are well in phase, and Friday's closing price annual cycle and congressional cycle echovectors are well coordinated with them as well.

_______________________________________________________________________

_______________________________________________________________________

GLD ETF 2-YEAR CONGRESSIONAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The longer solid yellow echovectors are 2-year congressional cycle echovectors, and the solid red, green, pink and blue-purple lines that are half as long are annual echovectors . Notice that the price updraft that follows next week well into August Options Expiration Week (3RD Trading Week of August) for both the annual echovector and the bi-quarterly echovectors also occurs in the 2-year congressional cycle echovector. Also notice that both the key "end of May" 1-year pink annual cycle price momentum echovector and "end of May" 2-year yellow congressional cycle price momentum echovector key are both parallel and overlap and their echobackdates are well in phase, and Friday's closing price annual cycle and congressional cycle echovectors are well coordinated with them as well.

_______________________________________________________________________

GLD ETF 4-YEAR PRESIDENTIAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The very long solid green and solid white lines are 4-year price momentum echovectors (Presidential Cycle). This coming week's key green presidential cycle slope momentum price echovector and its support extension (dotted green), and its extension intersect with other key echovectors this month are of key interest.

_______________________________________________________________________

GLD ETF 4-YEAR PRESIDENTIAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: Without sufficient price lift in the second half of this year, the 4-year presidential cycle price momentum echovector could pivot clockwise to negative, not the best prospect for gold or silver bulls.

_______________________________________________________________________

ANALYSIS CONCLUSIONS AND FORWARD POSITIONING STRATEGY

At this key time, as we enter what is typically the beginning of seasonal price strength in gold, my suggestion is to remain nimble, and be ready to take advantage of cyclical echovector pivot point long opportunities as well as potential echovector pivot point short opportunities, while also remaining protected with stops. And, to the more advanced trader, I would suggest even being tactically ready, in the event of relative counter-cyclical occurrences, to have order protocols already constructed and inputted that would readily trigger position polarity reversals as market price action dictated.

One way to accomplish this would be to set up an active and adjustable OTAPS-PPS position polarity switch and straddle to manage your gold or silver metals market exposure to any potential changes in the price level momentum with regard to your targets and forward outlook. Setting straddles at momentum echovector switch level prices is an effective and opportune measure and advanced trade and position management strategy.

One way to employ such a straddle would be to utilize the GLD and/or related ETFs or Ultras. By setting up an advanced trade technology (see "On-Off-Through Vector Target Price Switch") at, for example, $124.50 on the GLD, with appropriate dynamic triggers and stops included, such a straddle can be employed.

To perform the short side of the straddle, set a short trigger below this example target price switch level ($124.50 on the GLD) pre-programmed as a "repeating short trigger switch" at the trigger level on reverse down-tick action through the trigger price, with stops set to activate on reverse uptick up-through action.

To perform the long side of the straddle, set a long trigger above the target price switch level ($124.50 on the GLD)) pre-programmed as a "repeating long trigger switch" at the trigger level on reverse uptick action through the trigger, with stops set to activate on reverse down-tick down-through action.

This coming week may be a very good time to employ this market straddle and this more advanced trade technology switch and active position management methodology, especially when reviewing the current echovector analysis framecharts of the gold metals market.

Thanks for reading. And Godspeed in your gold and silver metals market investing.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Contributor, Alpha Brand Newsletters Group

Chief Market Strategist And EchoVector Analyst

PROTECTVEST AND ADVANCVEST

Kevin John Bradford Wilbur is the Chief Market Strategist and Senior EchoVector Analyst and Methodologist at PROTECTVEST AND ADVANCEVEST.

He is a prize-winning Economist and Financial Physicist with an over 35 year span of experience and awards in Academics, Research, Management, Practice and Trade. Kevin has specialized experience in the Major Market Indexes, Commodities, ETFs, and in derivatives and the derivatives markets.

Search market pivots to read more about Kevin John Bradford Wilbur and his specialty and about

For further information on constructing and calculating echovectors, coordinate forecast echovectors, and echovector pivot points, see

For further information on constructing and calculating otaps-pps position polarity cover and/or switch signal vectors and their trigger points, see

See

and

and

for further updates that might develop regarding this analysis.

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial adviser.

__________________________________________________________________________

Mining Gold's Price Motions: This Week's EchoVector Pivot Point Price Forecast And Analysis

Kevin Wilbur, Chief Market Strategist And Senior EchoVector Analysis Methodologist

Market Alpha Brand Newsletters Group, PROTECTVEST AND ADVANCVEST

Saturday, August 2, 2014

Saturday, August 2, 2014

UPDATED VERSION FOR ADDITIONAL SYNDICATION: AUGUST 3, 2014 3:37 AM ET |

Summary

- Both the month of August and this coming week are very important periods cyclically this year in the gold and silver metals markets.

- Technical price support in the 4-year, the 2-year, the annual, and the bi-cuarterly cycle Price Momentum Forecast EchoVectors all converge this coming week.

- Bulls hope 2014 is a gold price basing year. Yet without sufficient 2ND half year seasonal price lift presidential cycle EchoVector Slope Momentum will pivot negative.

- Possible seasonal precious metals price strength, a potential stock market correction, and recently announced further Fed Bond Purchase Tapering may bring sidelined bulls back to the gold and silver markets.

- The shorter quarterly EchoVector and monthly EchoVector both add little support to gold and silver prices and price lift at this juncture, so stops are particularly warranted in risk-on positions.

The month of August consistently proves to be a particularly important time in the gold and silver metals markets on a seasonal price basis. In 2013 I wrote several articles emphasizing this theme, suggesting would be buyers wait until summertime before becoming actionably bullish, if bullishness was their general bias outlook. Gold and silver metals prices have been basing this year after significant price declines last year from their lofty 2ND-half year 2011 and 2012 prices. Many gold and silver bulls are hoping this year's relative price action is setting the stage for a return to the trend of year-over-year price gains, and are looking positively towards this month again as what historically serves as the beginning of 2ND-half year seasonal price strength in gold and silver to support their aspirations for stronger prices going forward.

Additionally, this weekend marks the anniversary of the set of article's I wrote on this subject last summer. In the articles, I focused on fundamentals supporting positive gold price action into the fall, but I also warned about maintaining any long positions taken past fall and into years end, emphasizing instead the prudence of seasonal gold and silver swing trading. I also focused on an EchoVector Price Analysis Perspective in both gold and silver as well, reviewing them for the possible occurrences of annual price symmetries that might be forming, and these formation's potential trading implications forward into the rest of the year. This year the gold and silver metals markets are setting up once again for an important August month, and this coming week's price action appears in my focus as particularly significant once more. But let's first consider some current market fundamentals that may favor a potential for a seasonal gold and silver bounce, however potentially unexpected, yet once again this year.

FUNDAMENTALS SUPPORTING GOLD THIS WEEK

1. The timeliness of annual seasonality coming in for gold prices. August is often a key month for gold.

2. India, a major buyer of gold, appears to be have an ever-increasing appetite. The World Gold Council reports gold demand is likely to increase 20 percent by 2017.

3. US Stocks appear to many to be overbought after an historic 5-year bull run. Investors may look to gold as a haven from paper asset depreciation in the event of a market correct. Gold is still often considered a viable hedge by some analyst against a correction in stock prices (which some analysts are anticipating this August). Friday's gold market action in the wake of its strong stock market selloff continues to support this thesis.

4. Federal Reserve tapering is consistently underway and some think that relatively dovish Federal Reserve talk will give way to less dovish interest rate action down the road regarding interest rates, which may prove positive for gold.

5. Sentiment indicators among speculators in gold are hitting bearish extremes. Yet extreme bearish sentiment tends to be bullish.

6. Long positioning supporting articles on the gold miners are appearing again in August 2014, by some analyst, suggesting that the NUGT and other related gold miners funds possibly ready to move to the upside on a fundamental basis, which may indicate of further improved production cost to expected metals price ratios and demand than achieved last year.

TECHNICALS: A LOOK AT THE CHARTS

A current EchoVector Price Analysis Perspective of the GLD ETF GLD ETF reveals some very interesting recent price action as well. I've provided several charts below with echovector overlays to help highlight what this analysis currently suggests. They illustrate how the annual time cycle price momentum echovector this year has recently pivoted clockwise, from finally once again positive this year back again to a negative slope rate directional momentum (the longer solid white line compared to the longer solid red line on the first chart below -- that begins after the first).

However, in support of hopeful bulls, also note how this past Friday's "closing price annual cycle price momentum echovector (NYSE:AEV)" has, however slightly, pivoting counter-clockwise back again from these otherwise bearish previous "clockwise pivots" in the annual cycle price momentum echovector slope rates. This can be seen in the next solid white annual echovector that follows the previous two mentioned reading along "time", from left to right.

A forecast scenario opportunity for short-term long positioning uplift in the first half of this coming week could become apparent. Friday's strong price action favored this. Although Friday was possibly a bull trap, note how the forward two weeks on an annual echovector basis indicate price strengthening looking at price action in their echo-back-weeks in 2013 on into August 2103's key third week options expiration week. Note also how the solid yellow bi-quarterly echovector (in solid yellow) also currently supports this thesis of forward cyclical strength as well.

The approaching week's echovector pivot point strength does not end with the annual and bi-quarterly echovectors either. EchoVector Pivot Point Strength in the bi-quarterly cycle echovector (2QEV), the annual cycle echovector , the 2-year congressional cycle echovector (CCEV), and the 4-year presidential cycle echovector (PCEV) all converge. This could be considered quite technically positive for the potential for price lift going forward into the Fall for those considering a long biased swing trade in gold and/or silver.

However, as strong as the key longer term cycle convergences are, cause for concern still exists technically. The shorter quarterly cycle echovector (QEV) provides little support to significant or enduring price lift and extension, and the monthly cycle echovector (MEV) actually countervails lift altogether. So stops would be particularly warranted among any venturing long side risk-on bullishness pursuers..

How the longer term time cycle echovector pivot point price projection strengths play out against the relative weakness in the shorter term cycle echovectors, particularly right after key monthly options expiration, will be very interesting in its impact on the formation of price momentum levels and subsequent price echovector weights and tracks for the second half of this year, and well into next year too.

GLD ETF: 1-YEAR DAILY OHLC

ANNUAL CYCLE ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART PERSPECTIVES AND HIGHLIGHTS

(click to enlarge)

GLD ETF 2-YEAR DAILY OHLC

CONGRESSIONAL CYCLE ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART PERSPECTIVE AND HIGHLIGHTS

(click to enlarge)

4-YEAR DAILY OHLC

PRESIDENTIAL CYCLE ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART PERSPECTIVES AND HIGHLIGHTS

(click to enlarge)

ADDITIONAL FRAMECHART FOOTNOTES AND OBSERVATIONS

1. On the GLD ETF ANNUAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The longer solid yellow lines are bi-annual echovectors and the longer solid red, green, pink and blue-purple are annual echovectors. The shorter solid yellow lines are bi-quarterly echovectors. Notice the price updraft that follows next week well into August Options Expiration Week (3RD Trading Week of August) for both the annual echovector and the bi-quarterly echovectors.

2. On the GLD ETF 2-YEAR CONGRESSIONAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHART: The longer solid yellow echovectors are 2-year congressional cycle echovectors, and the solid red, green, pink and blue-purple lines that are half as long are annual echovectors . Notice that the price updraft that follows next week well into August Options Expiration Week (3RD Trading Week of August) for both the annual echovector and the bi-quarterly echovectors also occurs in the 2-year congressional cycle echovector. Also notice that both the key "end of May" 1-year pink annual cycle price momentum echovector and the key "end of May" 2-year yellow congressional cycle price momentum echovector are both parallel and overlap, their echobackdates are well in phase, and Friday's closing price annual cycle and congressional cycle echovectors are also well coordinated with them.

3. On the GLD ETF 4-YEAR PRESIDENTIAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: The very long solid green and solid white lines are 4-year price momentum echovectors (Presidential Cycle). This coming week's key green presidential cycle slope momentum price echovector and its support extension (dotted green), and its extension intersect with other key echovectors this month are of key interest.

4. On the GLD ETF 4-YEAR PRESIDENTIAL CYCLE PRICE MOMENTUM ECHOVECTOR FRAMECHARTS: Without sufficient price lift in the second half of this year, the 4-year presidential cycle price momentum echovector could pivot clockwise to negative, not the best prospect for gold or silver bulls.

ANALYSIS CONCLUSIONS AND FORWARD POSITIONING STRATEGY

At this key time, as we enter what is typically the beginning of seasonal price strength in gold, my suggestion is to remain nimble, and be ready to take advantage of cyclical echovector pivot point long opportunities as well as potential echovector pivot point short opportunities, while also remaining protected with stops. And, to the more advanced trader, I would suggest even being tactically ready, in the event of relative counter-cyclical occurrences, to have order protocols already constructed and inputted that would readily trigger position polarity reversals as market price action dictated.

One way to accomplish this would be to set up an active and adjustable OTAPS-PPS position polarity switch and straddle to manage your gold or silver metals market exposure to any potential changes in the price level momentum with regard to your targets and forward outlook. Setting straddles at momentum echovector switch level prices is an effective and opportune measure and advanced trade and position management strategy.

One way to employ such a straddle would be to utilize the GLD and/or related ETFs or Ultras. By setting up an advanced trade technology (see "On-Off-Through Vector Target Price Switch") at, for example, $124.50 on the GLD, with appropriate dynamic triggers and stops included, such a straddle can be employed.

To perform the short side of the straddle, set a short trigger below this example target price switch level ($124.50 on the GLD) pre-programmed as a "repeating short trigger switch" at the trigger level on reverse down-tick action through the trigger price, with stops set to activate on reverse uptick up-through action.

To perform the long side of the straddle, set a long trigger above the target price switch level ($124.50 on the GLD)) pre-programmed as a "repeating long trigger switch" at the trigger level on reverse uptick action through the trigger, with stops set to activate on reverse down-tick down-through action.

This coming week may be a very good time to employ this market straddle and this more advanced trade technology switch and active position management methodology, especially when reviewing the current echovector analysis framecharts of the gold metals market.

Thanks for reading. And Godspeed in your gold and silver metals market investing.

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial adviser.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in GLD over the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The potential long position mentioned that may be taken is actually an active advanced management straddle switch.

Subscribe to: Post Comments (Atom)

No comments:

Post a Comment