Today's EchoVector Pivot Point Chart And Analysis Update: Silver

includes:SLV

This year's dramatic gold and silver price declines are big news. However, since July price lows, some gold and silver analyst are suggesting a price bounce may now be underway, particularly in silver, which at a fundamental level may possess certain additional positives.

Silver is used more broadly than gold for industrial purposes. Silver demand overseas, particularly in Southwest Asia, has recently been reported to be reaching record levels. Silver coin demand in North America is stronger than ever on certain measures. HSBC, a significant bullion bank, sees silver prices remaining in a new and lower trading range this year, but still sees a potential upside target for the precious metal over that is 3 points higher than its current price occurring sometime before year's end. Recent options activity in silver also appears more bullish. Some indications of possible supply growth reductions in silver in the near-term currently exist. And forces inducing the central bank's generally loose monetary policy in the United States, high unemployment level in particular, appear unresolved.

In late August I presented "Today's EchoVector Pivot Point Chart And Analysis: Silver" which also looked at silver's annual price chart from an EchoVector Price Analysis Perspective highlighting occurrences of silver's annual price pattern symmetries' and the possible near-term trading implications of them. Significant symmetries were presented. I focused on the SLV ETF chart as my proxy for silver metals market price action. Today I would like to also provide a very interesting update to that SLV price chart I presented as well.

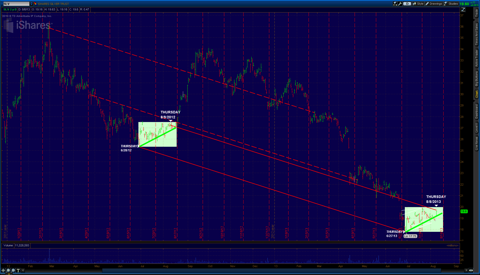

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

Looking at today's chart update, we can see once again very clearly the significant symmetry that emerged in the key active annual echovector (highlighted in solid red) running to this year's current price low on Thursday June 27 from its corresponding echo-back-date low one year earlier on Thursday June 28, 2012.

Thursday this week we had a gap open in the SLV, with good price extension through lunch time, and a close near the high of its daily trading range.

And very interestingly, we can now also see that the annual echovector to Thursday August 8 from its corresponding annual echo-back-date of Thursday August 9 2012 is a parallel, and that this same echovector momentum and powerful price symmetry coordination is still very much in effect.

This year's green highlighted time-price box which corresponds to last year's coordinate green time-price box (which continued last year until silver's price 'broke out' last August 20), and these boxes symmetry, also remain very much intact, and continue in remarkable coordination.

We can very interestingly see that this year's ascending green echo-price support vector located within this year's green box also served as the gap opening price support level in Thursday's relatively strong price action.

As I mentioned in July's article, analyst may find last year's price action and this year's effective symmetries very suggestive from an echovector pivot point perspective, and for forming their silver price outlook. And the next several week's could prove particularly interesting in this formulation. If a reasonable price echo and its extension in this period of August or September doesn't occur, additional short selling pressure to new price lows could form on a technical basis.

Silver's strong price up-draft last year occurred once prices broke out of the trade box in August after last August's significant 3RD Saturday options expiration date. This strong updraft and positive price extension lasted well into mid-September. These past price movements and patterns may become particularly significant to trader's as we move into this year's corresponding week's, given this year's current active price symmetries and coordinated price momentum currently active at these key time-points and their echovectors.

Thanks for reading. And good luck in your silver investing and trading!

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long SLV. I have a current swing trading position in SLV initially opened Friday August 31 2013. I may be looking to possibly add to my position as this week and month progress.

This article is tagged with: Gold & Precious Metals

This year's dramatic gold and silver price declines are big news. However, since July price lows, some gold and silver analyst are suggesting a price bounce may now be underway, particularly in silver, which at a fundamental level may possess certain additional positives.

Silver is used more broadly than gold for industrial purposes. Silver demand overseas, particularly in Southwest Asia, has recently been reported to be reaching record levels. Silver coin demand in North America is stronger than ever on certain measures. HSBC, a significant bullion bank, sees silver prices remaining in a new and lower trading range this year, but still sees a potential upside target for the precious metal over that is 3 points higher than its current price occurring sometime before year's end. Recent options activity in silver also appears more bullish. Some indications of possible supply growth reductions in silver in the near-term currently exist. And forces inducing the central bank's generally loose monetary policy in the United States, high unemployment level in particular, appear unresolved.

In late August I presented "Today's EchoVector Pivot Point Chart And Analysis: Silver" which also looked at silver's annual price chart from an EchoVector Price Analysis Perspective highlighting occurrences of silver's annual price pattern symmetries' and the possible near-term trading implications of them. Significant symmetries were presented. I focused on the SLV ETF chart as my proxy for silver metals market price action. Today I would like to also provide a very interesting update to that SLV price chart I presented as well.

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

Looking at today's chart update, we can see once again very clearly the significant symmetry that emerged in the key active annual echovector (highlighted in solid red) running to this year's current price low on Thursday June 27 from its corresponding echo-back-date low one year earlier on Thursday June 28, 2012.

Thursday this week we had a gap open in the SLV, with good price extension through lunch time, and a close near the high of its daily trading range.

And very interestingly, we can now also see that the annual echovector to Thursday August 8 from its corresponding annual echo-back-date of Thursday August 9 2012 is a parallel, and that this same echovector momentum and powerful price symmetry coordination is still very much in effect.

This year's green highlighted time-price box which corresponds to last year's coordinate green time-price box (which continued last year until silver's price 'broke out' last August 20), and these boxes symmetry, also remain very much intact, and continue in remarkable coordination.

We can very interestingly see that this year's ascending green echo-price support vector located within this year's green box also served as the gap opening price support level in Thursday's relatively strong price action.

As I mentioned in July's article, analyst may find last year's price action and this year's effective symmetries very suggestive from an echovector pivot point perspective, and for forming their silver price outlook. And the next several week's could prove particularly interesting in this formulation. If a reasonable price echo and its extension in this period of August or September doesn't occur, additional short selling pressure to new price lows could form on a technical basis.

Silver's strong price up-draft last year occurred once prices broke out of the trade box in August after last August's significant 3RD Saturday options expiration date. This strong updraft and positive price extension lasted well into mid-September. These past price movements and patterns may become particularly significant to trader's as we move into this year's corresponding week's, given this year's current active price symmetries and coordinated price momentum currently active at these key time-points and their echovectors.

Thanks for reading. And good luck in your silver investing and trading!

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long SLV. I have a current swing trading position in SLV initially opened Friday August 31 2013. I may be looking to possibly add to my position as this week and month progress.

No comments:

Post a Comment